All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. HMOs and PPOs are distinct healthcare plans and networks and each provides members with quality care and benefits.

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Primary Care Physicians PCP and Referrals.

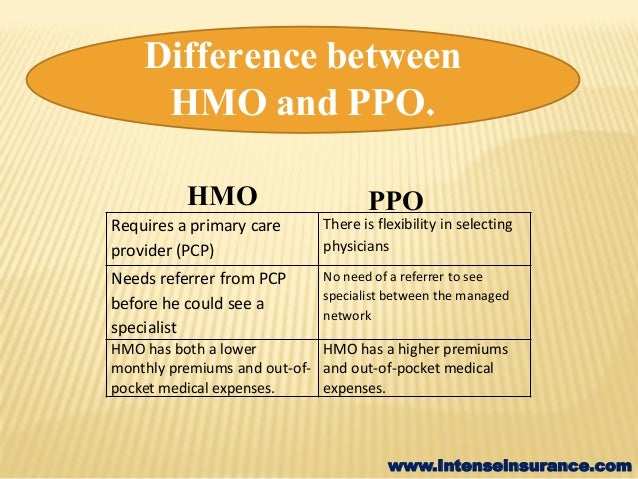

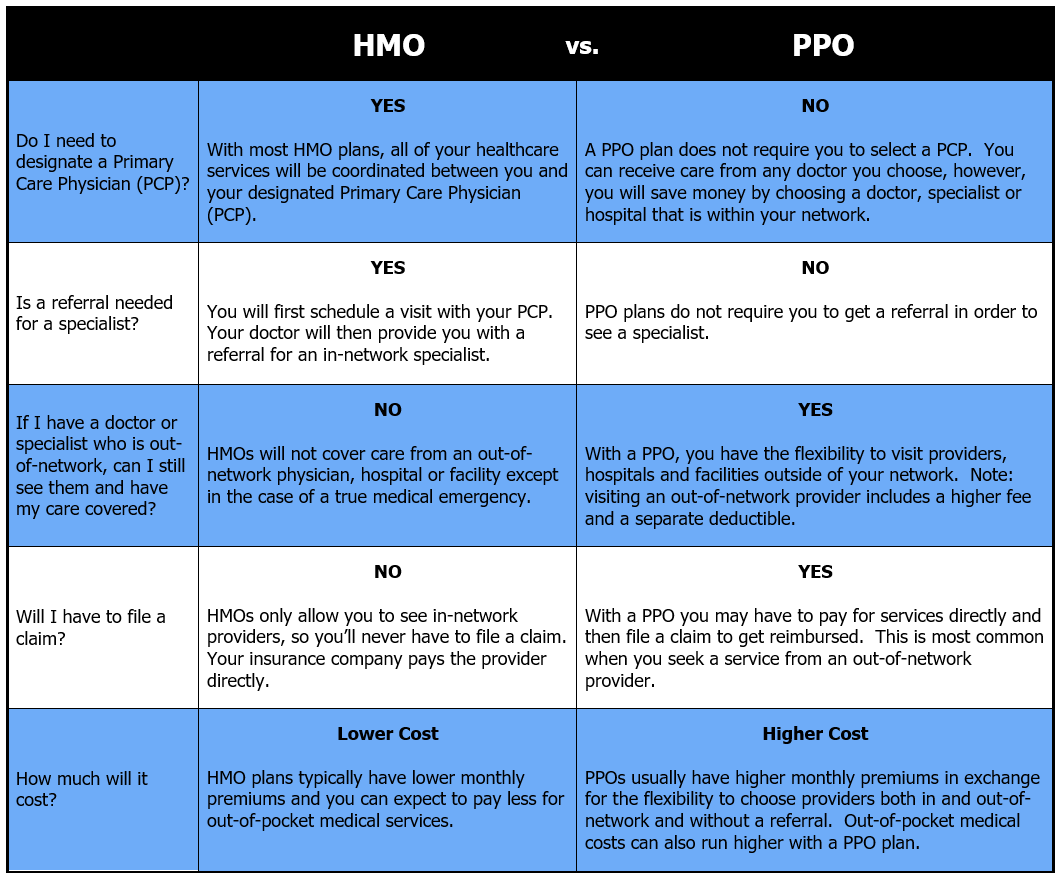

The difference between hmo and ppo. HMOs and POS plans require a primary care physician and referrals while PPO plans do not. While both Medicare HMO and PPO typically have more similarities than differences the main contrast comes down to premiums or higher costs in. The difference between them is the.

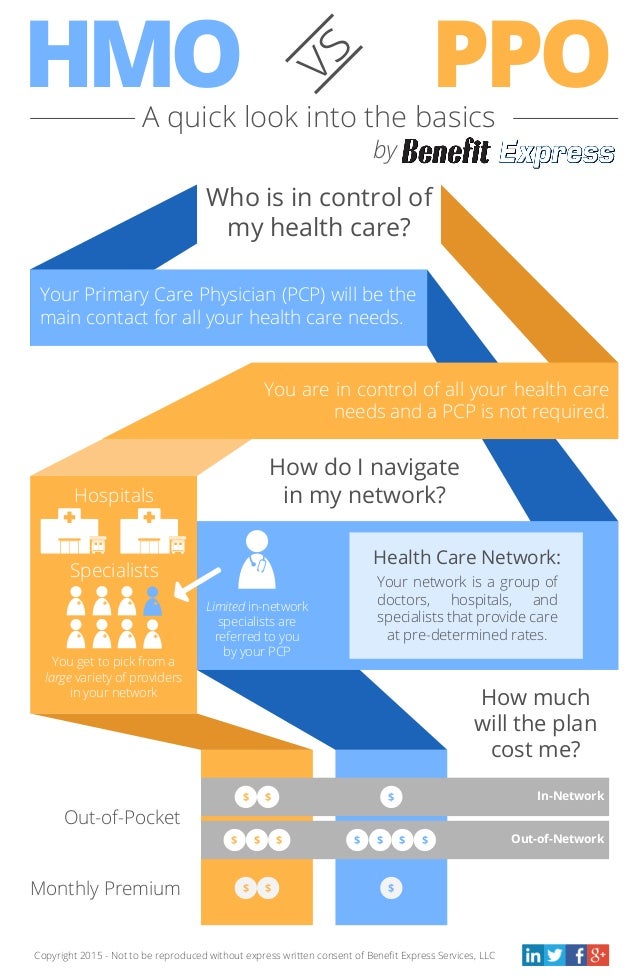

The central differences in HMO vs PPO vs POS plans are. PPO health plans are typically more expensive than HMO plans. Premiums and out-of-pockets costs for HMO plans are usually lower than a PPO.

They also have their own pros and cons. In addition with a HMO you might have a low deductible or even a no deductible health plan. After you reach the out-of-pocket maximum the insurance company will pay 100 percent of covered services.

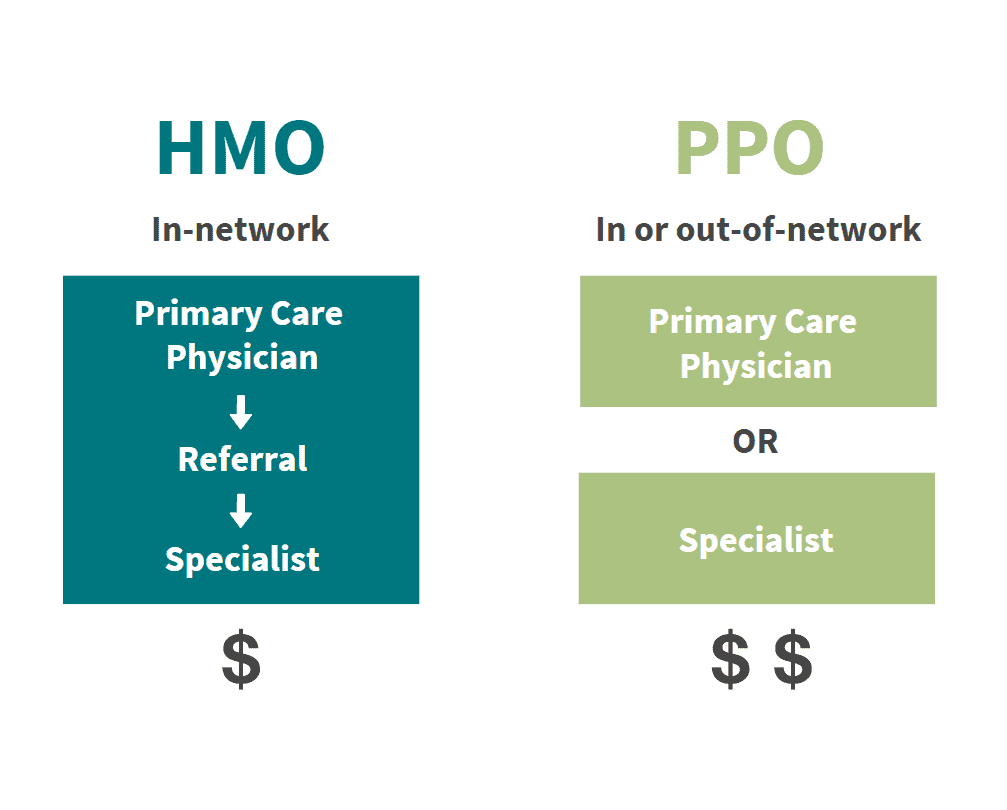

But the provider network for a HMO is less expansive. There also may be some differences in. 5 Zeilen As mentioned above Differences between HMO Health Maintenance Organization and PPO.

How can each plan benefit you and your family. Under HMO plans you have to pay 100 of the cost. How much you have to pay if you see a provider who is out of network.

Only for out-of-network claims. The main differences between them usually pertain to cost network size ability to see specialists and out-of-network coverage. If required PCP likely does it.

HMOs EPOs and POS plans often have no deductible or a low deductible. An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. Out-of-network care may have different rules.

PPO stands for preferred provider organization. Comparing Original Medicare HMO and PPO. Comparing an HMO vs PPO vs POS.

Difference between HMO and PPO. Typically lower in-network higher for out-of-network. That said PPO members can save money by seeing doctors that are within the PPO network as out-of-network providers will generally cost more.

Both HMO and PPO plans rely on using in-network providers. Depending upon the PPOs terms of coverage a doctor or hospital outside the preferred provider list will cost more than those in the network. Yes but requires PCP referral.

But the major differences. Individuals who are healthy with not many healthcare needs should opt for an HMO plan. The premium charge of an HMO plan is towards the lower end in comparison to PPO where the cost of the premium is comparatively high.

However if you have health issues and require frequent visits to the doctor then you must be looking for greater flexibility in your plan and hence a. The difference between HMO and PPO is that HMO restricts the use of services of the medical services within the network only while PPO puts in no such control. If required PCP does it for the patient.

The organization will typically pay a range of 70 to 80 percent of accrued expenses with the patient paying the remaining balance out-of-pocket. The differences besides acronyms are distinct. Under HMO only doctors from the selected network can be chosen whereas the employee can choose services from within the preferred network in PPO or can also consult someone from outside and then file for reimbursement with PPO.

The major differences between an HMO and PPO plan are in terms of cost plan-network size access to specialists and coverage for out-of-network services. HMO stands for health maintenance organization. Other than on preventative visits you will need to pay.

Whether or not you have to select a primary care physician who refers you to specialists. However PPO plans offer flexibility by covering out-of-network providers at a higher cost. When choosing a Medicare plan that is best for you or your loved ones you may want to consult a plan representative to better understand the advantages of each plan.

Difference Between Hmo And Ppo Difference Between

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Between Hmo And Ppo Which One Should You Choose

Between Hmo And Ppo Which One Should You Choose

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

What S The Difference Between An Hmo And A Ppo Aspen Wealth Management

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

What Is The Difference Of Hmo And Ppo Health Insurance Hmo Vs Ppo Youtube

What S The Difference Between Hmo And Ppo

What S The Difference Between Hmo And Ppo

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Hmo Vs Ppo Benefits Cost Comparison

Hmo Vs Ppo Benefits Cost Comparison

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.