For example if you have an 8020 plan it means your. It enables life insurers to turn over to a reinsurer the risk of either a portion of or an entire block whether the block be new or in-force.

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

To protect that property for its value you would need at least 200000 in property insurance coverage.

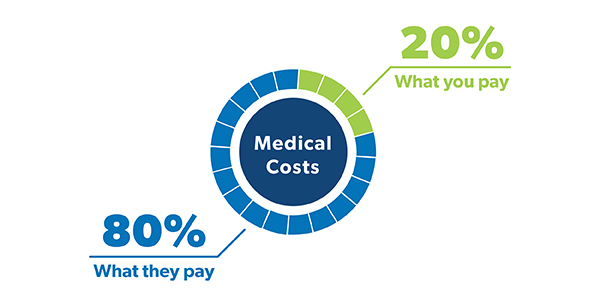

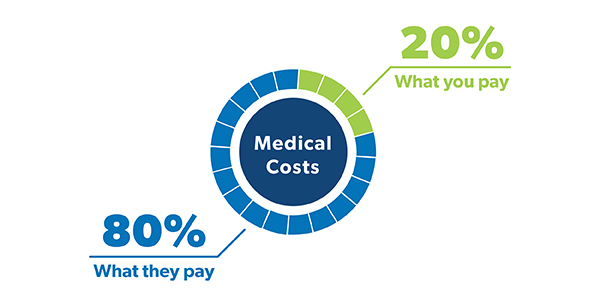

How does coinsurance work. For example your plan pays 70 percent. What Is Coinsurance and How Does It Work. Coinsurance is your share of the costs of a health care service.

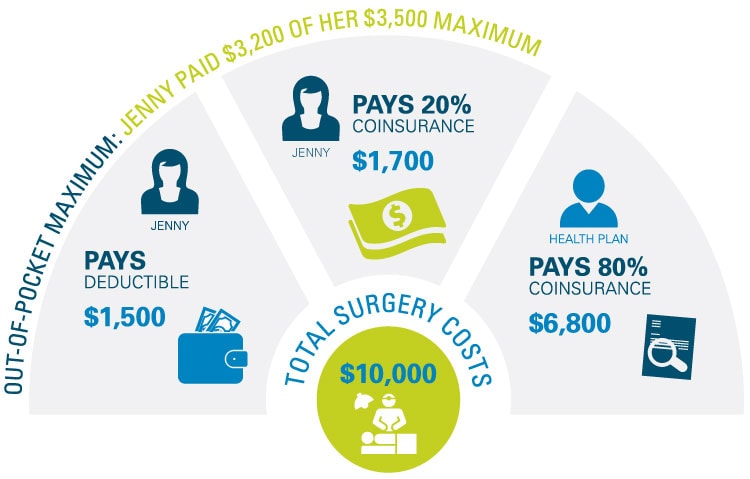

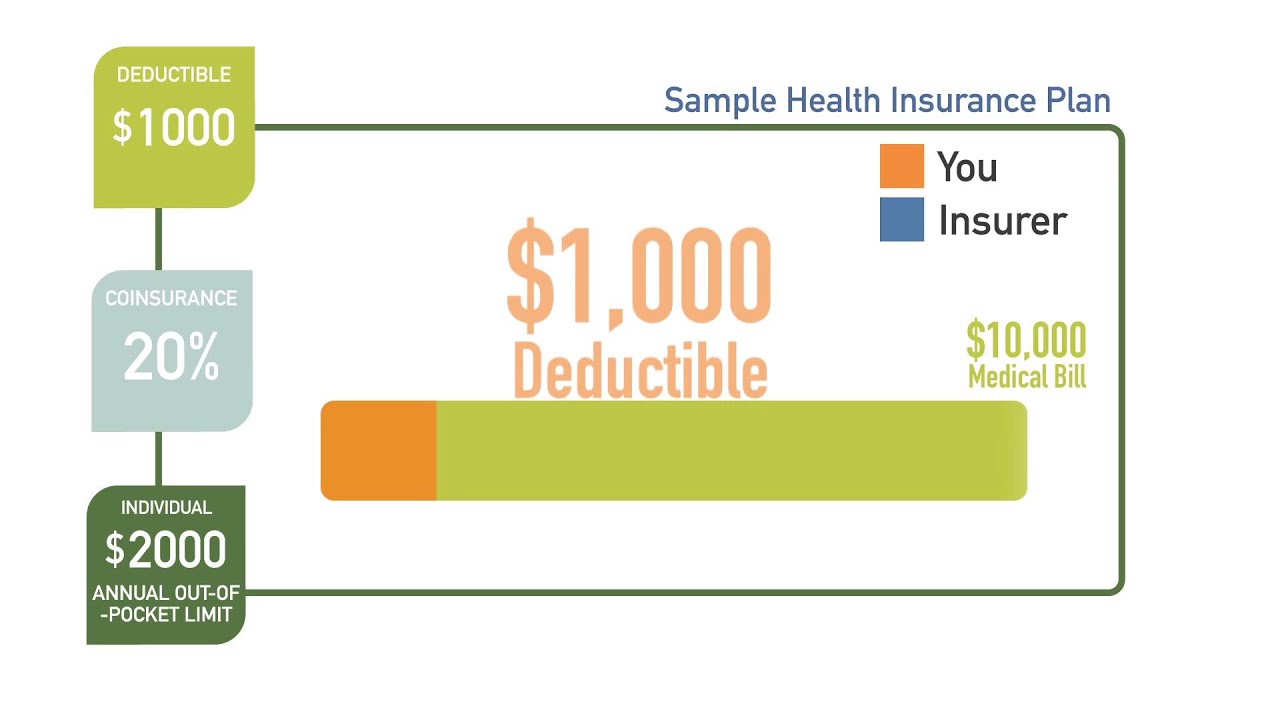

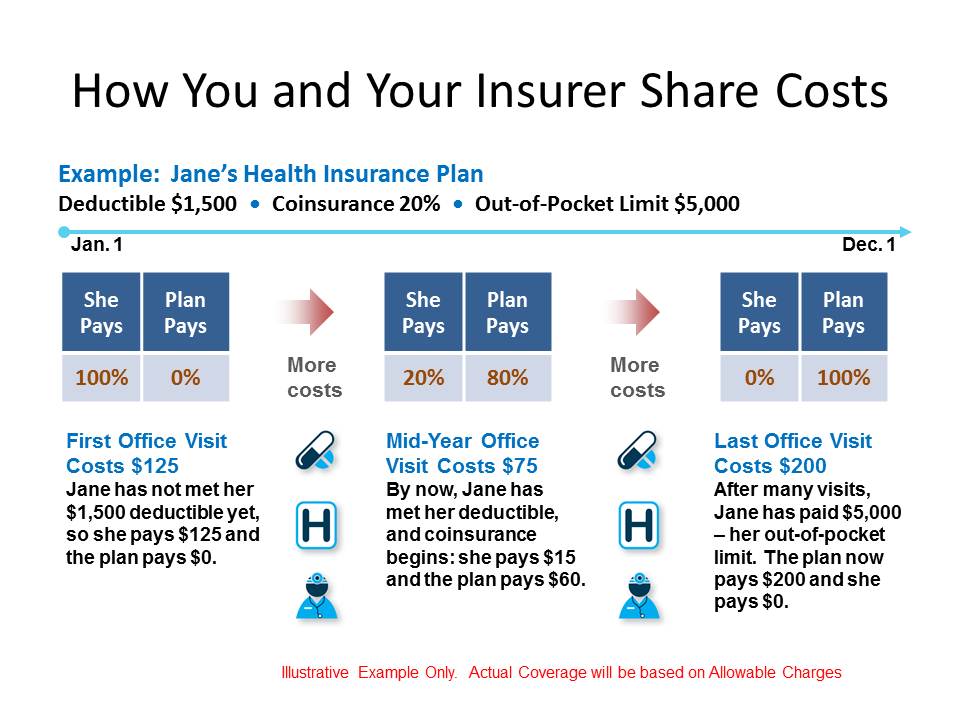

You start paying coinsurance after youve paid your plans deductible. For example a building with a value of 1000000 and a policy with an 80 percent coinsurance clause must be insured for at least 800000 to avoid a coinsurance. How does coinsurance work.

Its usually figured as a percentage of the amount we allow to be charged for services. Your health insurance plan pays the rest. The 30 percent you pay is your coinsurance.

Coinsurance also known as full-risk reinsurance is one of the simpler non-traditional ways to transfer risk. In a typical commercial property insurance policy a coinsurance clause ensures that you carry adequate coverage to protect your possessions. Youve paid 1500 in health care expenses and met your deductible.

Coinsurance is what youthe patientpay as your share toward a claim. Coinsurance is a form of cost-sharing or splitting the cost of a service or medication between the insurance company and consumer. This strategy removes the negative impact of this risk from the insurers balance sheets and.

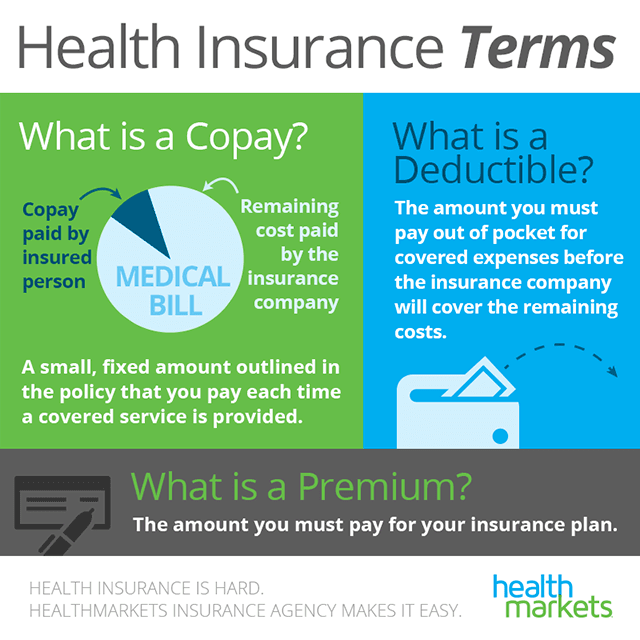

Coinsurance is the percentage of covered medical expenses you pay after youve met your deductible. Your deductible if you werent aware is the amount you have to pay. Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20.

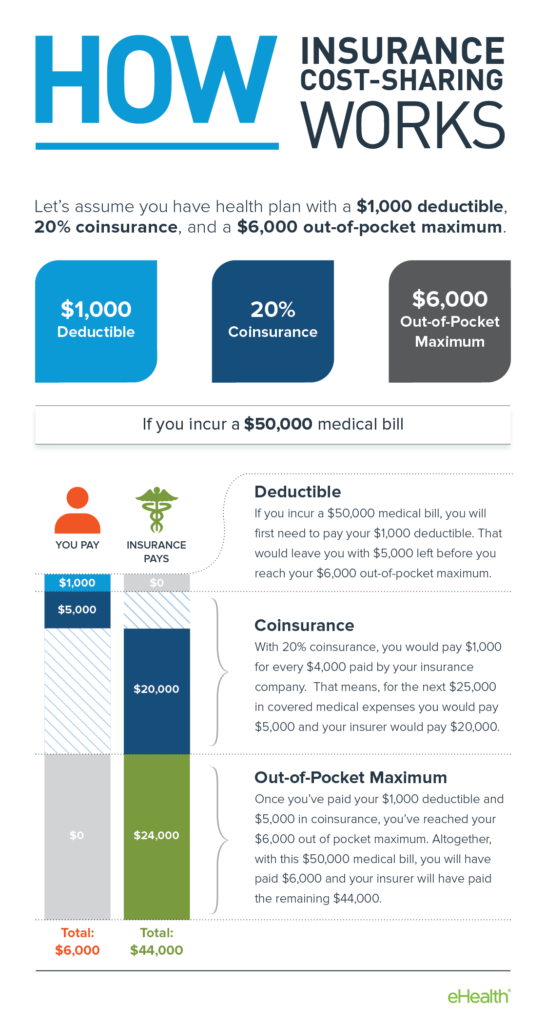

Coinsurance clauses are included in many property insurance policies that offer reimbursement based on a replacement cost the funds needed to reconstruct or repair a building with similar materials or actual cash value the replacement cost minus any depreciation. Coinsurance is the amount you will pay for a medical cost your health insurance covers after your deductible has been met. In simple terms the coinsurance clause forms part of a commercial property insurance policy and is imposed by insurers to encourage the policy holder to carry a limit of insurance that is equal to the value of property being insured or at least equal to a specified percentage of the value of the property.

The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible. We discuss in detail how coinsurance is a valuable insurance option to some than to others. The rate you pay in premiums for your health insurance will determine the amount that the company pays and portion in which you are responsible.

This design applies to medical and dental plans but dental coinsurance features a few unique characteristics. You typically pay coinsurance after meeting your annual deductible. What is the difference between coinsurance and copay.

Coinsurance is your portion of costs for health care services after youve met your deductible. You pay 20 of 100 or 20. Coinsurance is the percentage of costs of a covered health care service you pay after youve paid your deductible.

Once you reach the deductible your health insurance plan will pick up a percentage of the health care costs and youll pay for the rest. The insurance company pays the rest. Coinsurance is a type of cost-sharing a way of splitting the cost of treatment between you and the insurance company.

Say your office building is valued at 200000. Coinsurance Defined Coinsurance Explained A majority of property insurance policies contain a coinsurance provision. In the simplest terms the coinsurance provision in a property policy requires the policyholder to carry a limit of insurance equal to a specified percentage of the value of the property to receive full payment at the time of a loss.

If youve paid your deductible. When you go to the doctor instead of paying all costs you and your plan share the cost. A coinsurance provision requires the insured to insure the covered property to a specified percentage of its full value typically 80 90 or 100 percent.

Coinsurance is an insurance policy that splits the cost of your health care bills between you and the insurance company in essence a cost-sharing arrangement.

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Health Insurance Costs Understand What You Might Pay If You Have A Health Insurance Plan With Deductibles Health Insurance Plans Health Insurance Work Health

Health Insurance Costs Understand What You Might Pay If You Have A Health Insurance Plan With Deductibles Health Insurance Plans Health Insurance Work Health

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

Benefits A Z What Is Coinsurance Financial Benefit Services Blog

Benefits A Z What Is Coinsurance Financial Benefit Services Blog

Small Business How Does Coinsurance Work Ehealth

Small Business How Does Coinsurance Work Ehealth

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Texas

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Texas

How Does A Coinsurance Work With A Health Insurance Policy Youtube

How Does A Coinsurance Work With A Health Insurance Policy Youtube

Coinsurance And Medical Claims

Coinsurance And Medical Claims

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.