Overall the differences between the two plans will sway your decision on which one you would prefer to get. I have been investing in HMOs since 2011.

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Between talk of deductibles copays coinsurance and coverage areas your head is likely.

Should i get a ppo or hmo. Even if this was mistake the tax. Choosing between an HMO or a PPO health plan doesnt have to be complicated. Some health insurance plans wont pay a dime for services.

But what if you get sick a few states away from your home and you cant find an in-network physician. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network. Like HMO plans a PPO plan will typically have copayments on non-preventive medical care.

Differences Between HMO Plans and PPO Plans. The pros of an HMO plan is the cost which normally have lower premiums than PPOit really depends on your employer. Depending on the carrier you enroll with for example it may be able to cover alternative procedures like acupuncture.

POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO. If you have a big family and know what doctor you want to use as your family doctor getting their preferred HMO is certainly a good bet. HMO plans do not require a deductible PPO plans do.

A mortgage for an HMO is more difficult to get and a bigger deposit is most likely going to be required. On the other hand an HM tends to be less costly than a PPO because the patient does not pay as many fees such as copays and deductibles. Medicare HMO PPO Medicare also has both PPO and HMO options.

The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of. Thus this is sort of like an even more limited version of an HMO where the insurer brokers a deal with a very specific provider network. However many PPO plans will also have an annual deductible and higher premiums.

If you are new to health insurance you may want to choose a PPO for the flexibility. Also many HMO plans completely cover the cost of maternity care or a large portion of it. You will need a.

I realize I have not considered the tax advantage of the HSA account but my 2015 tax software calculated that I owed 27100 in taxes on the HSA account. I started off self-managing the properties I bought and as a result learned a lot about what systems and processes you need to put in place. When it comes to HMO vs PPO there are a few additional key feature differences that you should consider before you select a plan.

HMO costs are prepaid PPO costs are not. Certain services and medications must be pre-authorized and you may need to do the paperwork especially if you want to see a specialist who is out-of-network. A PPO dental plan will typically have a larger network of dental providers and youll be able to switch dentists or see a specialist without a referral from a primary care dentist.

If your primary concern in monetary the HMO is probably a better selection. HMOs arent better than PPOs rather it depends upon your family and your region which one will be better for you. PPO coverage typically extends further than that of other common health insurance plans.

Making a decision about the best health insurance plan for you or your family is a difficult choice. HMO plans have fixed prices for services PPO plans have varied costs. The systems and processes are.

Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care. However the cons of having an HMO health insurance plan during pregnancy is that you are restricted to your primary care physician. PPO Insurance Plans PPO dental plans entail higher out-of-pocket costs than DHMO plans but they also offer a greater degree of flexibility when choosing a dentist or dental facility.

A Point of Service or POS plan is a hybrid HMOPPO. Main differences between HMO and PPO plans. Finally there is the mortgage.

Like HMOs many POS plans require you to have a PCP referral for all care whether its in or out-of-network. In general an HMO is more restrictive for the patient than a PPO requiring all treatment to be done inside the network. This difference can only get larger because HDHPHSA is 20 across the board and the Traditional plan still has co-payments for some expenses which are less than the 20.

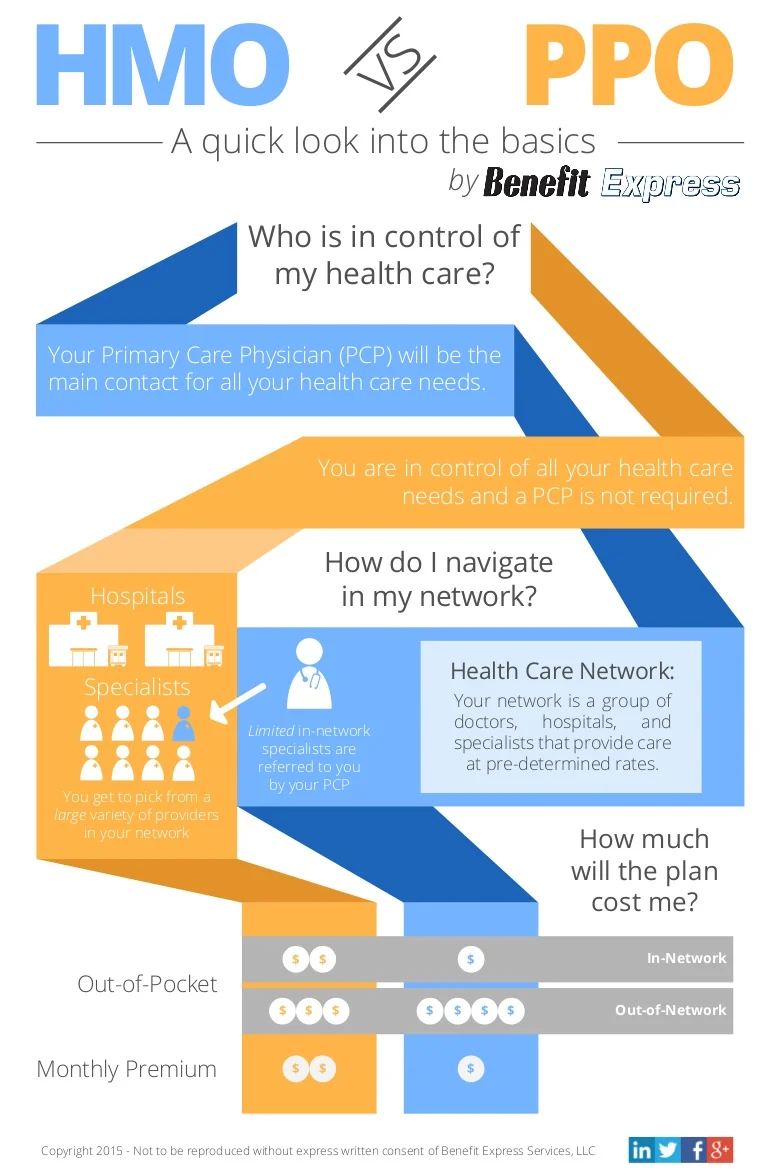

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

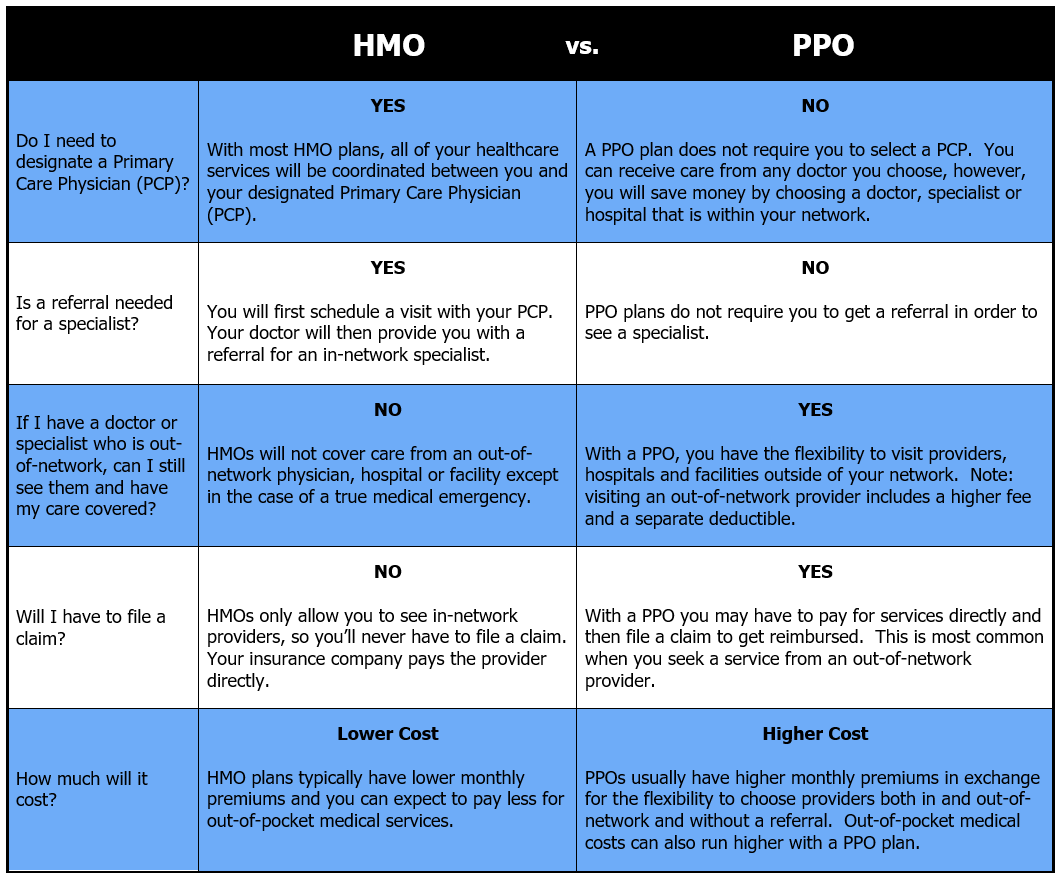

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

What S The Difference Between Hmo And Ppo

What S The Difference Between Hmo And Ppo

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Difference Between Hmo And Ppo Difference Between

Compare Hmo Ppo And Cdhp Plans Healthcare Healthinsurance Best Health Insurance Health Insurance Healthcare Plan

Compare Hmo Ppo And Cdhp Plans Healthcare Healthinsurance Best Health Insurance Health Insurance Healthcare Plan

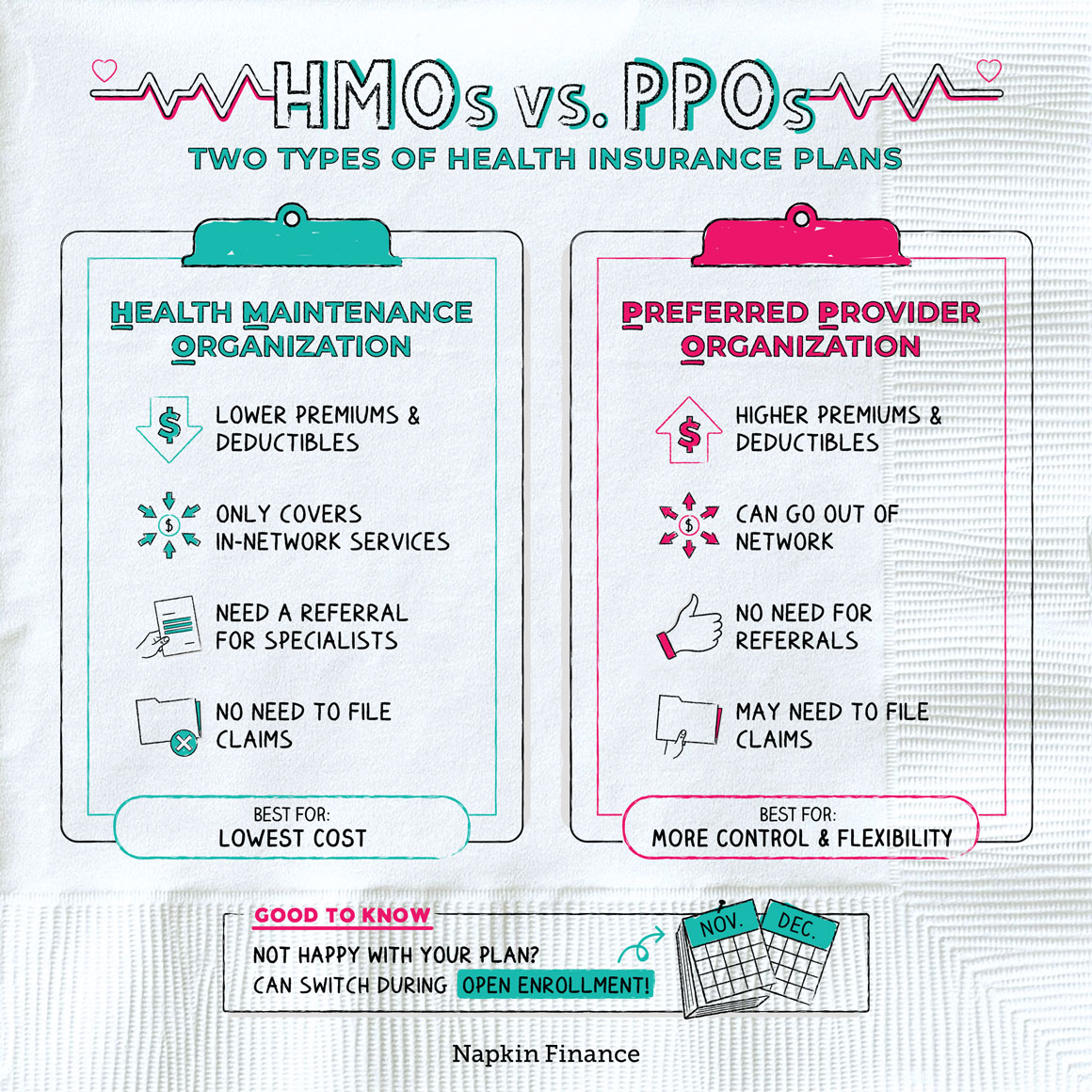

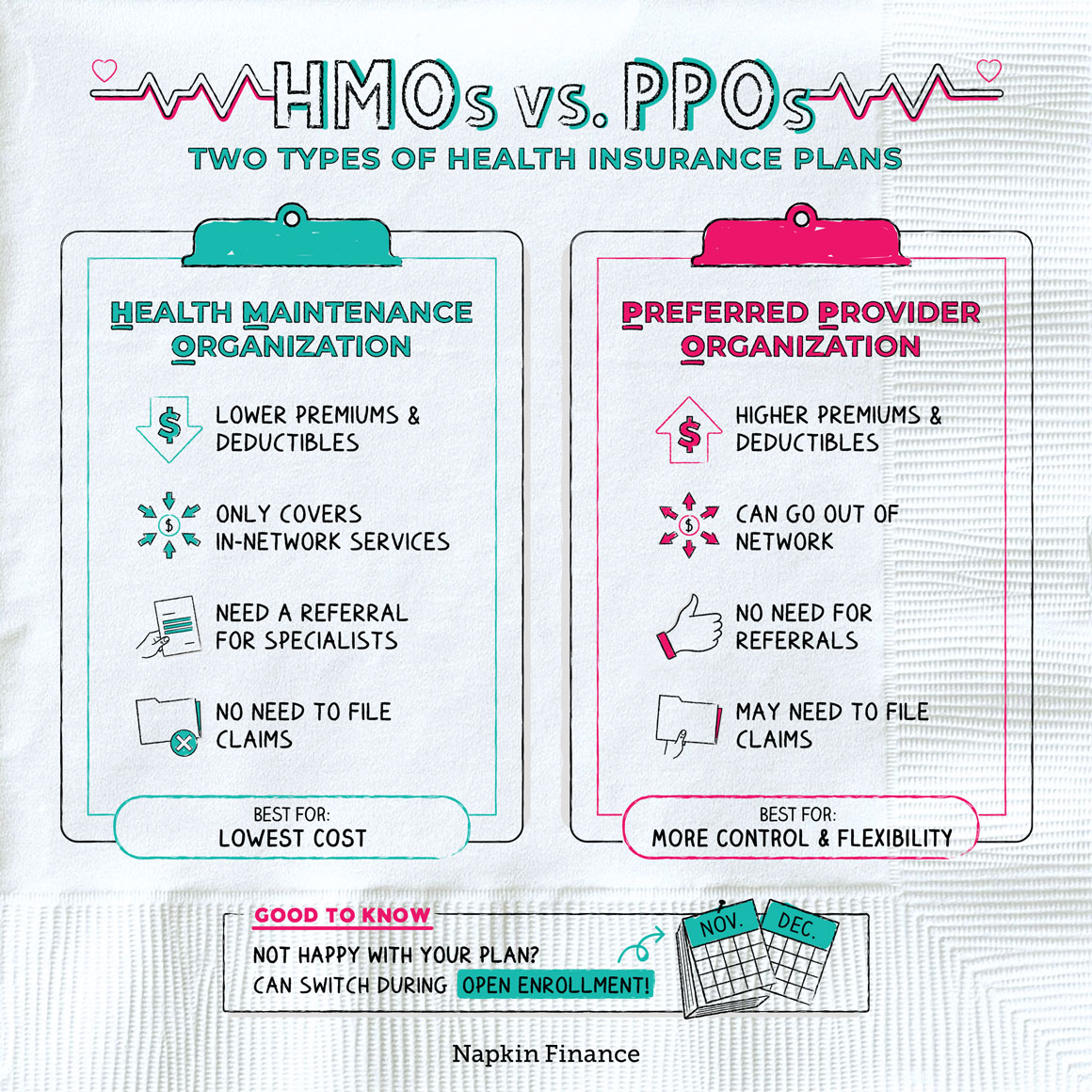

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.