Covered California Complaint Form. Pay a penalty when they file their state tax return.

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

Privacy Complaint Form by a Parent Guardian or Authorized Representative.

Covered california tax form. If you dont have a login and. Obtain an exemption from the requirement to have coverage. Request to Correct or Dispute Tax Forms.

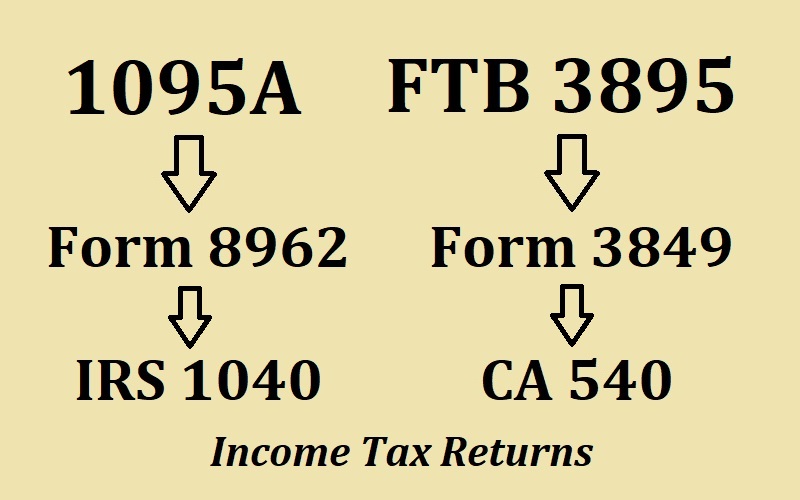

The 1095-A Form is a Covered California statement that is needed to file your Federal Income Tax Return. It is used to fill out Form FTB 3849 Premium Assistance Subsidy as part of your state tax return. Use the California Franchise Tax Board forms finder to view these forms.

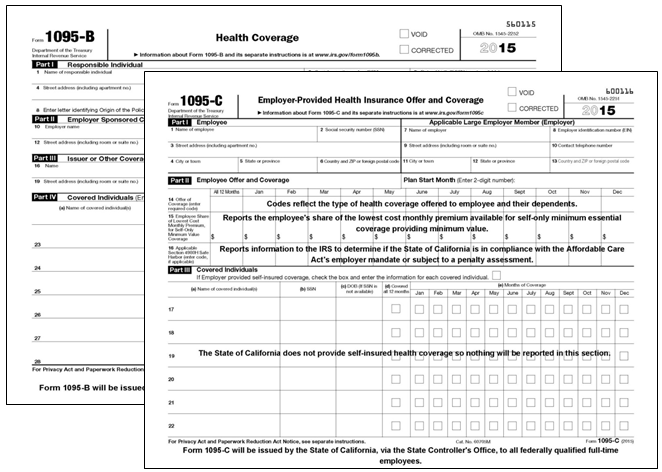

All State forms and publications. The 1095A is a tax document that lets the IRS know how much Covered Ca tax subsidy you were eligible for and how much tax subsidy you received. Form 1095-B Individuals who enroll in health insurance through Medi-Cal Medicare and other insurance companies or coverage providers will receive this form.

The web address for the Covered California Account Login is. Can I print it online. What is a 1095-A Form.

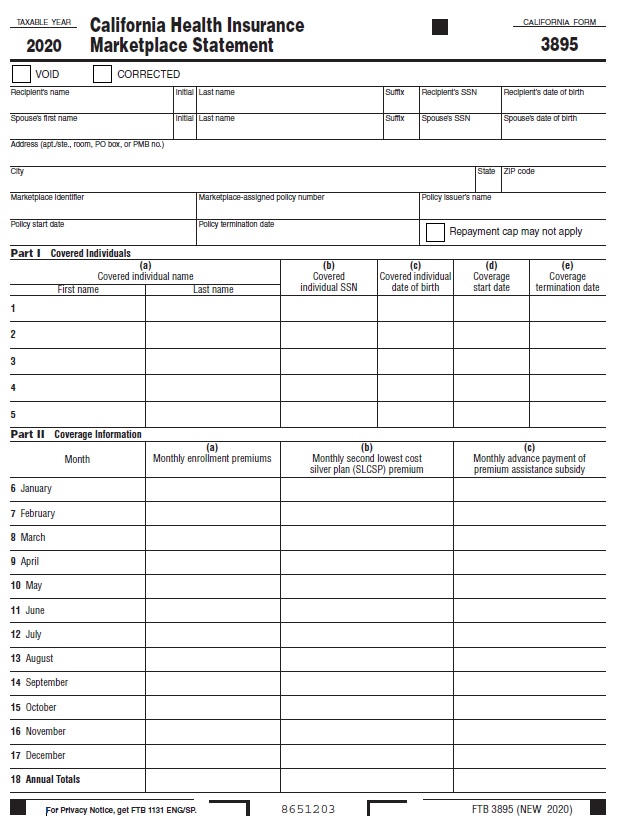

Covered California will send Form FTB 3895 California Health Insurance Marketplace Statement to all enrolled members. Due to state and federal tax law changes were revising tax forms and instructions. It shows how many months you had health insurance and how much Advanced Premium Tax Credit APTC you received.

In the first open enrollment period we helped 100s of existing Covered Ca account holders finalize their application after they ran into issues. If you received a tax credit in 2015 through Covered CA then you are required to file your Tax Return AND reconcile these tax credits on form 8962. For California the reconciliation is on FTB form 3849.

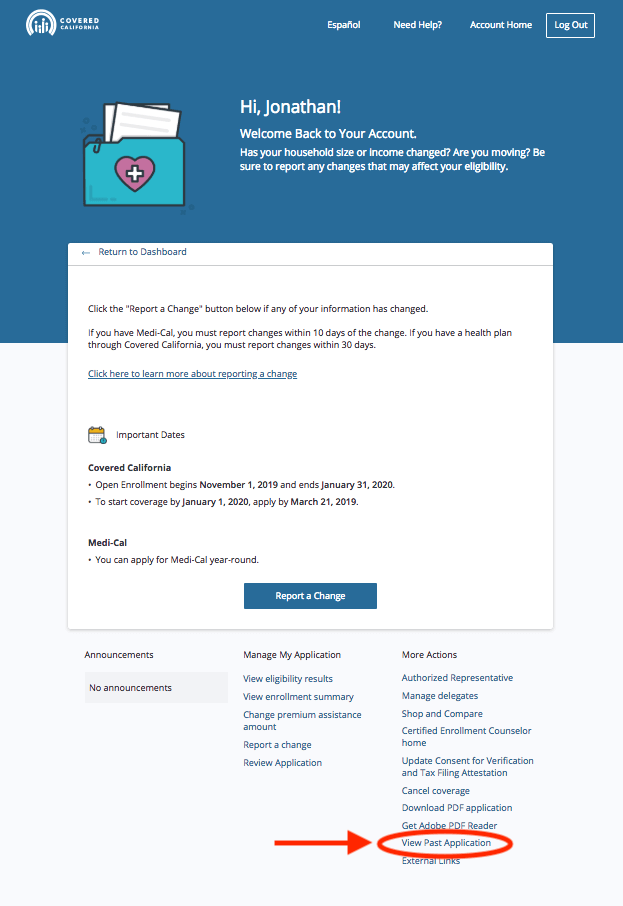

If you chose email as your communication preference you will receive an email that your tax forms are available to access through your Covered California secured mailbox. Beginning January 1 2020 California residents must either. I would like to know what website I can go to to print out my Tax Form 1095A.

If you have not received your 1095 A and you were a member of Covered California complete the form above and get your 1095A today. If you were a customer of Covered Ca you can not correctly file your taxes without a 1095A. You could get multiple federal and state forms if members of your household were enrolled in different.

It is your proof that you had health insurance in place so that you wont be subject to a tax penalty. Form 1095-C Individuals who enroll in health insurance. Members who did not file their 2015 Federal Tax Return with form 8962 are at risk of losing their tax credits.

For individuals and families who may have already repaid the federal excess Premium Tax Credit the IRS is advising not to file an amended return to recoup the money paid on their federal tax return. Answering your Covered California application in certain ways can keep you from getting a subsidy that you may be eligible for. Do you need your 1095A so you can file your taxes.

You will need to sign in to your account to download and print your forms. Form 1095-A Individuals who enroll in health insurance through Covered California or the Federal Marketplace will get this form. It is used to fill out IRS Form 8962 Premium Tax Credit as part of your federal tax return.

Without it you can not properly complete IRS Form. Have qualifying health insurance coverage. The reconciliation of the federal Premium Tax Credits occurs on form 8962.

All Federal forms and publications. Appeal and Complaint Forms. 46 Zeilen If you are receiving any these types of income then please use the calculation.

If the recent tax law changes do not affect you you can still file with these forms. Request for a State Fair Hearing to Appeal a Covered California Eligibility Determination. Income Tax Forms State.

You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. Bilingual Services Complaint Form. A good percentage of these applications north of 50 had errors in how they answered.

Tax Filing Status and Covered California Subsidy. IRS Form 1095-A Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members.

Covered California Ftb 3895 And 1095a Statements 2020

Covered California Ftb 3895 And 1095a Statements 2020

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Where Is The Money Going Covered California Sends Wrong Tax Info To 100 000 Customers Ca News

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Https Hbex Coveredca Com Toolkit Pdfs Nod62b Pdf

Http Hbex Coveredca Com Toolkit Webinars Briefings Downloads 1095 A B C Quick Guide Final Pdf

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

Helping Your Clients With Their Health Care Tax Forms L A Care Health Plan

Helping Your Clients With Their Health Care Tax Forms L A Care Health Plan

Covered California Ftb 3895 And 1095a Statements 2020

Tax Credits Solid Health Insurance

Tax Credits Solid Health Insurance

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

Irs Form 1095 A Health For California Insurance Center

Irs Form 1095 A Health For California Insurance Center

Covered California Ftb 3895 And 1095a Statements 2020

Covered California Ftb 3895 And 1095a Statements 2020

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.