As a certified small businessmicro business you are eligible for the States Small Business Participation Program. As the owner of your own business if your taxes are not withheld in the normal course of your business you must make estimated tax payments using Form 1040-ES Estimated Tax for Individuals.

California Tax Forms H R Block

California Tax Forms H R Block

Sole proprietorships partnerships and LLCs are much simpler entities.

California small business tax forms. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. 30 percent of corporate taxes are due by April 15 40 percent by June 15 and the remaining 30 percent by Dec. A 5 percent bid preference on applicable State solicitations.

Gross incomes of 5 million or greater pay a tax of 11790. Be advised that the New Business Late-Submission Acknowledgement Form is an optional form. FORMS.

All State forms and publications. 3 01-20 Acknowledgement of Licensee Responsibilities Under the California Interstate User Diesel Fuel Tax. CorporationsLimited Liability Company LLC California Gig Economy Tax Center.

Acknowledgement of Licensee Responsibilities Under the International Fuel Tax Agreement. Form 944 Employers Annual Federal Tax Return. State Tax Forms and Information.

Form 2553 Election By a Small Business Corporation. Covered California for Small Business has updated its application submission deadlines for 2021. Form 8829 Expenses for Business Use of Your Home.

Tax Credits. Employer and Hiring Information. This guide is for small businesses filing their tax returns on Schedule C with their personal returns Form 1040.

Individual Tax Return Form 1040 Instructions. Articles of Incorporation Certificate of Organization Fictitious Name of Registration Government-issued Business License sole proprietors without fictitious. You wont receive a tax deduction for donating services.

Form 6252 Installment Sale Income. The IRS has specific reporting requirements when a small business donates. This program sets a goal for the use of small businesses.

2019 tax returns or Form 990s copy of official filing with the California Secretary of State if applicable or local municipality for the business such as one of the following. Upon meeting the Small Business Certification eligibility requirements certified small business SBs and micro businesses MBs are entitled to the following benefits. Mortgage interest is tax-deductible but this year the deduction has been adjusted.

The corporate tax rate in California is 884 percent and C corporations must pay their taxes in installments. For businesses with less than 250000 in gross income the 800 minimum franchise tax applies. This article will explain and list the most common and best tax deductions for California homeowners.

Assistance in Running your Business. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility Initiative of the World Wide Web Consortium at a minimum. Access to California Department of Tax and Fee Administration Records.

Small Business Assistance Center Starting Your Business. Form 2848 Power of Attorney and Declaration of Representative. If the group does not agree to the submission acknowledgement the effective date will be the first of the month following the requested effective date.

Form SS-5 Application for a Social Security Card PDF PDF Form 1045 Application for Tentative Refund. Federal income tax is a pay-as-you-go tax. Tax Guide for Small Business.

Request for Transcript of Tax Return. Eligible small business owners file this form annually to report federal income tax withheld and FICA tax Social Security and Medicare taxes on employee wages as well as calculate and report their employer Social Security and Medicare tax. Formerly if you were an employee your employer withheld income tax from your pay.

Copy of official filing with the California Secretary of State which must be active if applicable or local municipality for your business such as one of the following which must be provided in electronic format for upload such as PDFJPEG or other approved upload format. It includes sole proprietors and single-member LLC owners. 11 The net income from an LLC passes.

Helpful guides and commonly used publications and forms for businesses. The deduction is limited to interest on up to 750000 of debt 375000 if youre married filing separately instead of 1 million of debt 500000 if married filing separately. If your business is a corporation or S corporation check out the Complete Guide for Corporations and S Corporations If it is a multiple-owner LLC or a partnership here is a Guide for Business Taxes for Partnerships.

Federal Tax Deductions for Small Business Charitable Donations. Cannabis business income tax. But you may be able to deduct expenses related to the donation like.

Small businesses can receive a tax deduction for making charitable donation. Close dissolvesurrendercancel my business. Instructions for Form 1040 Form W-9.

Filing A Schedule C For An Llc H R Block

Filing A Schedule C For An Llc H R Block

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png) Form 1120 S U S Income Tax Return For An S Corporation Definition

Form 1120 S U S Income Tax Return For An S Corporation Definition

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

2020 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

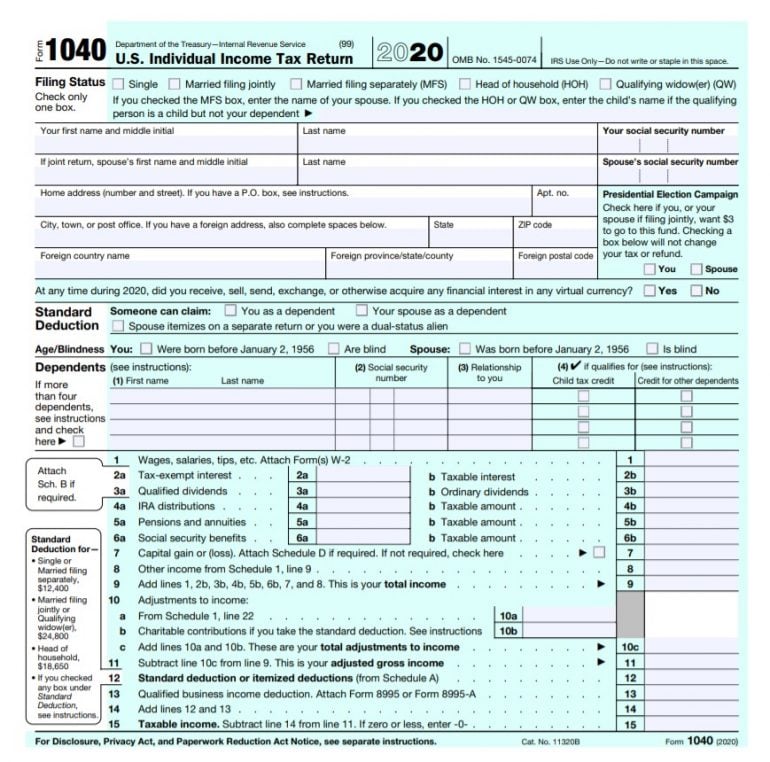

Irs Form 1040 Individual Income Tax Return 2021 Nerdwallet

Irs Form 1040 Individual Income Tax Return 2021 Nerdwallet

3565 Form Small Business Stock Questionnaire

109 Form Exempt Organization Business Income Tax Return

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png) Form 2106 Employee Business Expenses Definition

Form 2106 Employee Business Expenses Definition

Irs Form 1040 Individual Income Tax Return 2021 Nerdwallet

Irs Form 1040 Individual Income Tax Return 2021 Nerdwallet

Irs Form 1095 A Health For California Insurance Center

Irs Form 1095 A Health For California Insurance Center

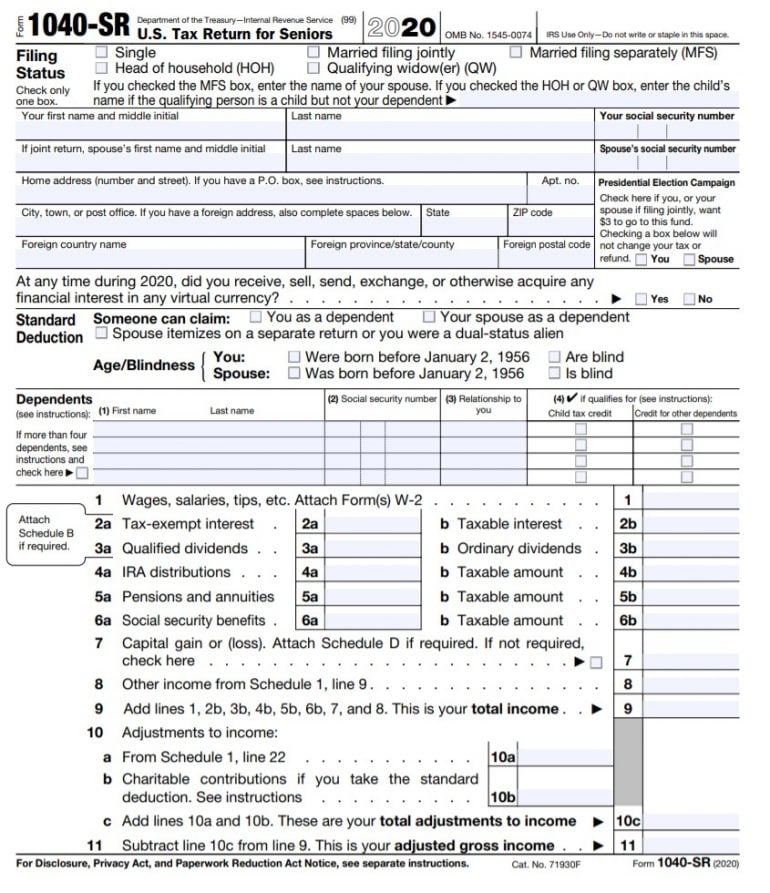

Irs Releases Draft Form 1040 Here S What S New For 2020

Irs Releases Draft Form 1040 Here S What S New For 2020

:max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png)

:max_bytes(150000):strip_icc()/Screenshot43-d22959eda68841df96f3e8f1bb223a34.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.