DEMOCRATS PUSH 36B SUBSIDY FOR OBAMACARE IN MONSTER SPENDING BILL Understanding how the tax credit is calculated requires knowing two numbers. Use our calculator to see how much youll be eligible for.

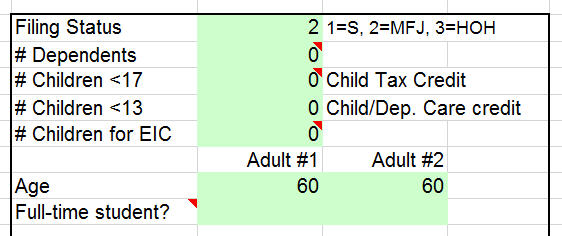

Tax Calculator With Aca Health Insurance Subsidy

Tax Calculator With Aca Health Insurance Subsidy

Again subsidies have increased for 2021 and will remain larger in 2022 due to.

Obamacare subsidy calculator 2020. The American Rescue Plan Act of 2021 lowered the applicable percentages significantly in 2021 and 2022 from previous years. 2021 ACA Subsidy Calculator. The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019.

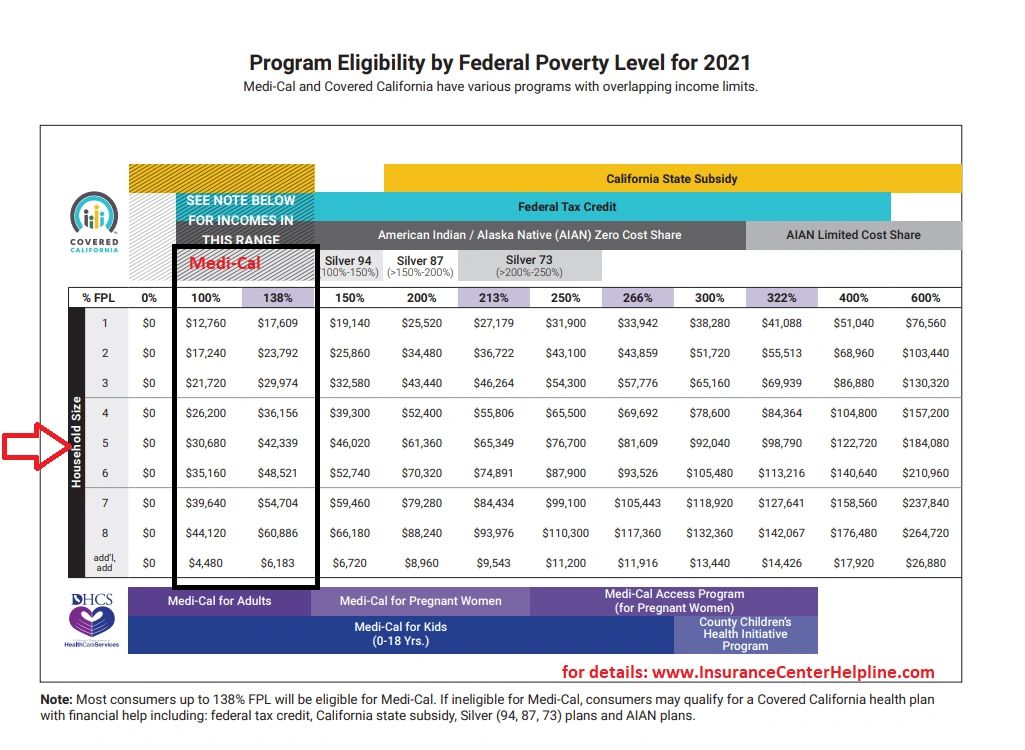

This Subsidy Calculator is based on formulas and regulations defined by the Affordable Care Act ACAObamacare. 3 Americans in this income range are caught in the trap where they make too much for Medicaid but not enough to afford private health plans. 2020 Subsidy Tax Penalty Calculator For 2020 if you earn less than 47080 as an individual or 97000 for a family of 4 youll receive a tax subsidy to help you pay for some or all of your insurance.

That means the exchange will send about 455month to his insurer and Rick will have to pay the other 43month. Use this quick health insurance tax credit guide to help you understand the process. 2017 Obamacare Subsidy Calculator Provided by.

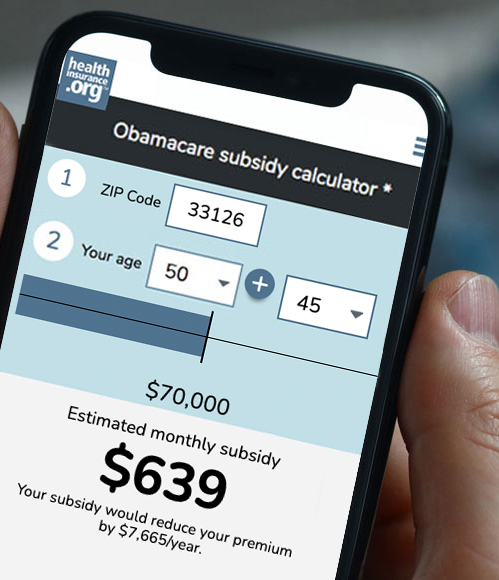

Max Contribution percentage. Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace. The Health Insurance Marketplace Calculator allows you to enter household income in terms of 2020 dollars or as a percent of the Federal poverty level.

Potential Risks Loom As The Final Deadline Approaches. Premiums displayed in the calculators results are based on actual exchange premiums in 2021. 2020 Obamacare Premium Tax Calculator By A Noonan Moose on October 28 2019 In 2020 the federal government will once again offer a Premium Tax Credit PTC to qualifying taxpayers who buy health coverage from an approved health insurance exchange.

For example in 2020 people with income between 250 and 300 of the Federal Poverty Level were expected to pay between 829 and 978 of their income toward a second lowest-cost Silver plan in their area. For example a 28-year-old single person making. The law created a system that provides financial help to low and middle income families in the form of a subsidy.

Enter a few details such as ones income ZIP code and age and the Kaiser Family Foundation calculator will show the amount of the tax credit. To calculate his subsidy he just needs to subtract 510 the amount he kicks in over the course of 2021 from 5976 the total cost of the benchmark plan over the course of 2021. About the 2020 2021 Obamacare Subsidy Calculator The purpose of this subsidy calculator is to provide Americans with the ability to quickly determine if they are eligible for subsidized health insurance under the Affordable Care Act.

Could you get a federal subsidy for health insurance. To receive a PTC you must split the uprights between making too little and too much income. The maximum percentage of MAGI that a household will need to pay for the Second-Lowest Cost Silver Plan SLCSP eg.

Government Cracking Down On Sign Ups Outside of Open Enrollment January 17 2016. If you already enrolled in an ACA plan and got a subsidy you can change your plan and get the added savings. You qualify for subsidies if pay more than 85 of your household income toward health insurance.

Premiums will drop on average about 50 per person per month or 85 per policy per month. His subsidy will be about 5466 for the year. The actual subsidy value is equal to the full cost of the SLSCP minus the expected household contribution.

The calculator spits out 0 subsidies which is a glitch implying such applicants pay 0 to next to nothing for annual health care premiums. The first is the amount of income that Obamacare. This subsidy calculator is provided by My1HR a licensed Web Based Entity WBE which is certified by the Centers for Medicare and Medicaid Services CMS to connect consumers directly with the.

Or just use one of the ObamaCare subsidy calculators found below for a quick estimate on marketplace cost assistance. Enter the required information into the fields below then calculate your results. The calculator includes subsidy increases for 2021 in the American Rescue Plan Act ARP of 2021.

Household income includes incomes of the. Obamacare Health Plans This page features a 2021 ObamaCare eligibility chart the 2020 federal poverty level used for 2021 subsidies and a subsidy calculator. Key Dates August 16 2017.

Obamacare Enrollment Ends January 31. In 2020 for 300-400 FPL the maximum contribution is 978. In 2020 for example thats a family of four with an income between 26200 and 104800 a year.

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Aca Open Enrollment What If You Make Too Much For A Subsidy The New York Times

Aca Open Enrollment What If You Make Too Much For A Subsidy The New York Times

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.