HSAs are a form of medical savings account that must be accompanied by a high-deductible health insurance plan. Here are some important details that can help you decide if a plan with a high deductible is right for you.

Comparing Hdhp Vs Ppo Plans Am I Missing Something Personal Finance Money Stack Exchange

Comparing Hdhp Vs Ppo Plans Am I Missing Something Personal Finance Money Stack Exchange

Consumer Reports recommends selecting a.

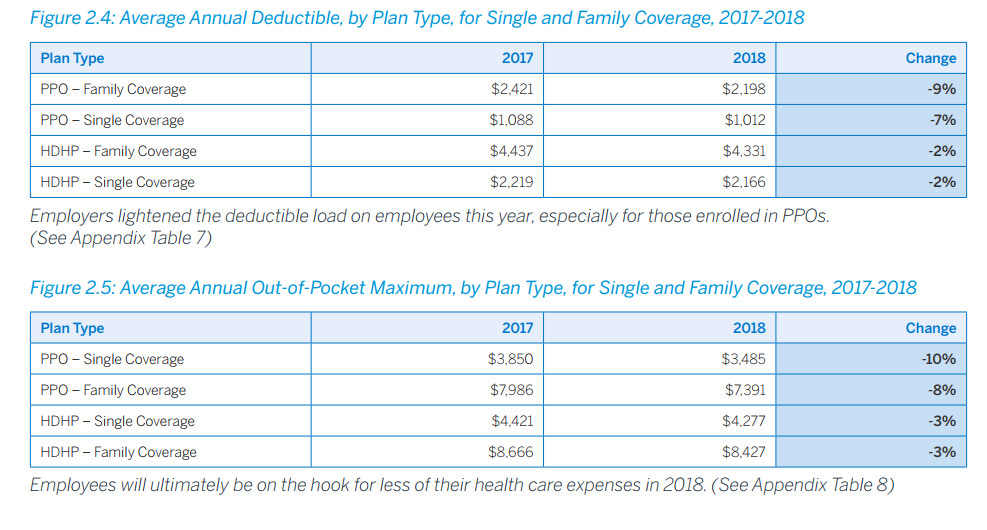

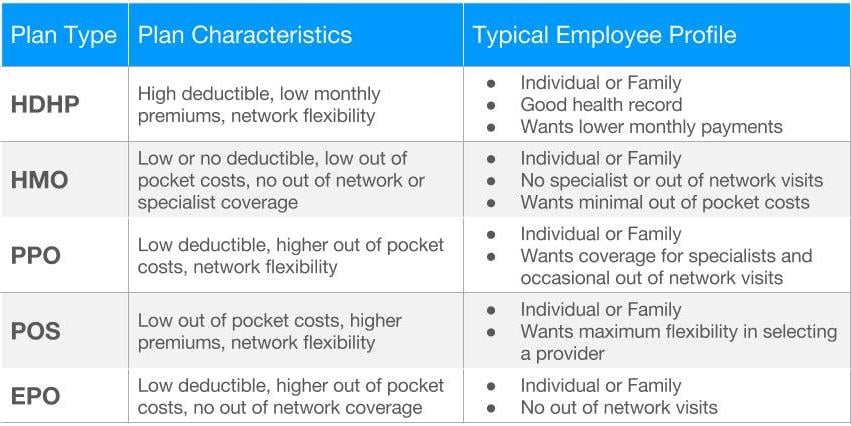

High deductible ppo. How does a high-deductible health plan work. A high-deductible health plan HDHP is any health plan that typically has a lower monthly premium and a higher deductible than traditional plans. Deductibles of at least 1400 for an individual or 2800 for a family are the minimum deductibles youll see in these plans.

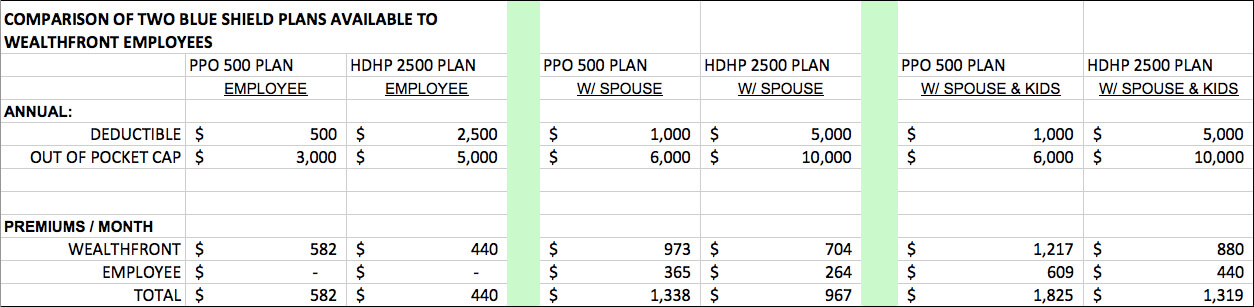

It would be a no brainer for most employees to choose the high deductible plan. The high-deductible health plan HDHP is frequently among the health insurance choices offered by companies these days. Higher deductible in network.

High-Deductible Health Plans Defined According to IRS rules an HDHP is a health insurance plan with a deductible of at least 1400 if you have an individual planor a. What if the employees shares of the premium are close. Having a high deductible provides an advantage to the health care consumer by reducing their monthly premium for ongoing coverage.

HSAs allow individualsemployers to set aside money on a pre-tax or tax-deductible basis and then withdraw the money tax-free to pay qualifying medical expenses. You meet the deductible and then pay coinsurance for services you receive. Lower monthly contributions payroll deductions for coverage.

A High-Deductible Health Plan is a type of health insurance plan that as its name implies has a higher deductible than traditional insurance plans such as an HMO EPO or PPO. The PPO choice would have been a 630 a month premium with 3000 dollar co pays and a 2500 deductible but no HSA and NO FREE MONEY from the company. A High Deductible Health Plan HDHP has low premiums but higher immediate out-of-pocket costs.

The telltale sign of HDHPs is that you will have a larger deductible to meet than a standard deductible plan. 1400 per person 2800 per family. Employers often pair HDHPs with a Health Savings Account HSA funded to cover some or all of your deductible.

Use this calculator to help compare a traditional low-deductible health plan to a high-deductible health plan accompanied by an. A preferred provider organization PPO operates as a network of health care providers that provide health services. HDHPs or High Deductible Health Plans Like the name says this type of plans deductible is higher than most traditional plans.

You are permitted to visit doctors in your network or outside of it without the need for a referral. While having a high deductible health plan may sound intimidating in reality HDHPs deductibles can end up being comparable to those of todays PPO plans. Remember the graph above showed that the average PPO plans individual deductible is between 1000 and 2000.

You may also deposit pre-tax dollars in your account to. For 2020 the IRS defines an HDHP as any plan with a deductible of. The 3100 difference covers the difference in the deductible.

PPO subscribers typically pay a co-payment per provider visit or they must meet a deductible before insurance covers or pays the claim. After crunching the numbers between the two it was pretty much a wash at the end of the year if you used the insurance plans equally up to meeting the deductible of each plan. What is a high-deductible health plan.

PPO plans tend to charge higher premiums because they are. If you choose the high deductible plan you pay 1600 less in your share of the premium and you get another 1500 from the employer in your HSA. In fact youll find high deductible plans in both HMOs and PPOs.

An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA that is meant to fund some of your medical expenses. To qualify as an HDHP the IRS says a plan must have a deductible of at least 1350 for an individual and 2700 for a family. According to the Wall Street Journal a typical PPO might come with a deductible of 250 while a standard HDHP could come with a deductible of 2500.

Health Savings Account HSA and Limited Purpose FSA for dental and vision.

Think Carefully Before Signing Up For A High Deductible Health Plan

Think Carefully Before Signing Up For A High Deductible Health Plan

Comparing Health Plan Types Kaiser Permanente

Ppo Vs High Deductible Choose Beta

Ppo Vs High Deductible Choose Beta

Consumer Directed Care High Deductibles Popular For Employees

Consumer Directed Care High Deductibles Popular For Employees

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Comparing Hdhp Vs Ppo Plans Am I Missing Something Personal Finance Money Stack Exchange

Comparing Hdhp Vs Ppo Plans Am I Missing Something Personal Finance Money Stack Exchange

Hdhp Vs Ppo Which Is Right For You Ramseysolutions Com

Hdhp Vs Ppo Which Is Right For You Ramseysolutions Com

Hdhp Vs Ppo What S The Difference

Hdhp Vs Ppo What S The Difference

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

What Is An Hdhp Your Guide To High Deductible Health Plans

What Is An Hdhp Your Guide To High Deductible Health Plans

Why Would Anyone Choose This Ppo Over Ppo Hsa Personal Finance Money Stack Exchange

Why Would Anyone Choose This Ppo Over Ppo Hsa Personal Finance Money Stack Exchange

Hsa Vs Ppo Motivhealth Insurance Company

Hsa Vs Ppo Motivhealth Insurance Company

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.