Tax Forms and Filing. Based on the 1000s of successfully enrolled Covered Ca members a quick snapshot.

Covered California Can T See Your Tax Return

Covered California Can T See Your Tax Return

In the first scenario the couple entered Covered California with an estimated MAGI of 55000.

Covered california and taxes. This is the recommended method if your annual income stays at a constant level from year to year. US citizens and US nationals. 51 of Enrollees qualify for Enhanced Silver Plans.

If you dont have a login and password call 800-300-1506. It was clear on form 8962 that the addition of the Polks social security retirement income and tax-exempt interest had pushed the Polk household income over 400 of the federal poverty line. Apparently you claimed a lower income on your Covered California application in the first place.

Lawfully present individuals in the US include. Their annual federal Premium Tax Credit was 21115 1760month and the California Premium Assistance Subsidy was 376 31month. Unless you report that you had health coverage you may have to pay a state tax penalty.

4 Other California State Excise Taxes. Covered California and claim you as a tax dependent you may qualify for premium assistance or help paying for health insurance. Again as certified Covered California agents there is.

Covered California offers minimum coverage plans a type of health insurance that. Whether you get financial help or not health coverage is part of filing your taxes. If your parents do not claim you as a tax dependent you can buy a plan through Covered California and still qualify for premium assistance based on your income.

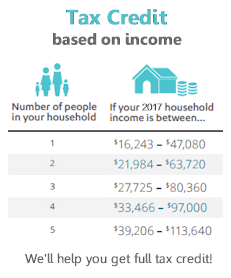

For covered california ins what income do I use. Combined with local sales taxes the rate can reach as high as 1025 in some California cities although the average is 866 as of 2020. 88 of Californians qualify for a tax credit.

Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients. Now Im super worried because its tax time and both agencies didnt care about my income fluctuations and Covered California had me at 17k when I made 31k instead. The web address for the Covered California Account Login is.

Medi-Cal Eligibility and Covered California - Frequently Asked Questions. After logging in youll be on the Consumer Home Screen. Californias average local tax rate is 141 as of 2020 and the highest local tax rate comes in at 25.

One notewhen enrolling in Covered California you essentially confirm that you will file taxes as required by law and on time if you are required to. If you received federal or state financial help youll report that as well. These forms are used when you file your.

However when they did their federal income tax return for 2020 their final MAGI was 65000. Use the California Franchise Tax Board forms finder to view this form. The California Form FTB 3895 California Health Insurance Marketplace Statement.

Generally the projected annual income on your Covered California application should match your Adjusted Gross Income line 8b of the 1040 from your most recent Federal Tax Return. This wasnt new information. Look for the list of links in the bottom-center of the page.

Lastly since as I said I had two cases in Covered California for no apparent reason they used my other case for taxes- this is the one without the change of address and without income fluctuations. The federal IRS Form 1095-A Health Insurance Marketplace Statement. Read about the required tax forms and how your health coverage relates to your taxes in the Tax.

Unless you qualify to be exempted you could pay tax penalties if you go for more than two months without any coverage. I dont mind paying premiums back but I. Some people do not need to file taxes since their income is below the threshold.

Average tax credit of 302. To correct this you must notify Covered California of your actual income. If you do not find an answer to your question please contact your local county office from our County Listings page or email us at.

Click on Eligibility Results. That is why you have to repay all the the advance premium tax credits you received for the year. The CPA had properly taken the Covered California 1095-A and completed IRS form 8962 Premium Tax Reconciliation.

From IRS form 1040 line 22 total income or line 37 adjusted gross income or line 43 taxable income. Line 37 plus Tax. This reduced their annual federal subsidy to 20137 and the California.

During tax season Covered California sends two forms to members. Back to Medi-Cal Eligibility. ACA California requires US citizens US nationals and permanent residents to have health coverage that meets the minimum requirements.

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Step By Step Income Calculation For Obamacare In California

Step By Step Income Calculation For Obamacare In California

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Ftb 3895 And 1095a Statements 2020

Health Insurance And Taxes How To Take Advantage Of Financial Help And Avoid Penalties

Tax Refunds Just Got More Complicated Because Of Covered California

Tax Refunds Just Got More Complicated Because Of Covered California

Metallic Plan Benefits Covered California Health For Ca

Metallic Plan Benefits Covered California Health For Ca

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.