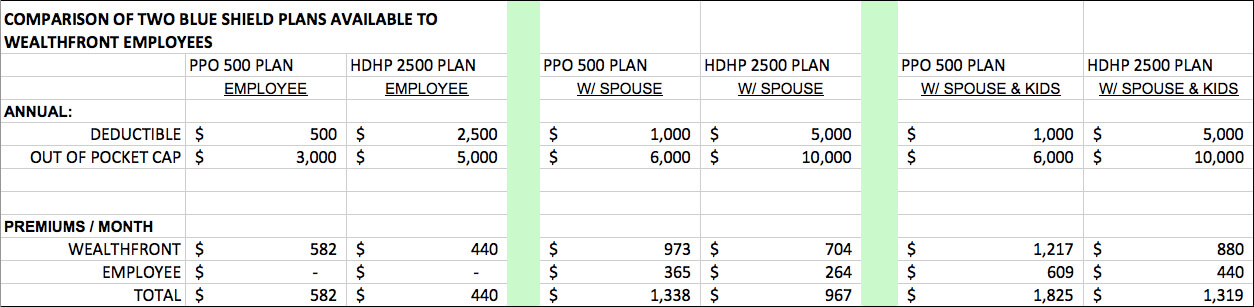

My companys HSA plan has a 3k family deductible and 9k out of pocket maximum. Here we will take a look at the difference between using your HSA or a Health Saving Account and acquiring the services of a PPO or a Preferred Provider Organization.

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

An HSA Health Savings Account is a savings account you can use with a high-deductible health plan HDHP.

What is the difference between hsa and ppo. If PPO members use providers that are considered in-networkincluding hospitals and doctorsthe medical services are discounted to a pre-negotiated rate or covered entirely by the plan. But if youre considering an EPO you should check approved. When deciding between youre an EPO and a PPO there is a multitude of factors you must consider.

A Preferred Provider Organization PPO has pricier premiums than an HMO or POS. Its not a form of health insurance. Although this feature can be a big help it can also be a wash financially by the time you pay all of your premiums for the year.

You will pay the full cost of items such as prescription drugs and office visits until the plans deductible amount is met. But one crucial thing to remember is that unlike a PPO plan an HSA is not a health insurance plan. The key difference between HSA and PPO health insurance is that HSA is a tax-advantaged health benefit plan exclusively available to taxpayers in the United States who are enrolled in a High-Deductible Health Plan HDHP whereas PPO is a cost sharing health plan that collaborates with medical services providers such as hospitals doctors and other medical.

Because HSAs must be paired with a high-deductible health plan your health insurance premiums are normally much lower than a typical PPO plan with a 500 or 1000 deductible. Even though the HSA plan has both a higher deductible and a higher coinsurance percentage the huge gap in premiums and the lack of an employer HSA contribution under the PPO plan put it at a big disadvantage. An HSA account helps you save for medical expenses.

A preferred provider organization PPO is a health plan that offers participants an extensive network of healthcare providers. The HSA-HDHP connection results in lower health insurance premiums than a typical PPO plan with a 500 or 1000 deductible. The PPO typically has a lower maximum out-of-pocket cost than an HDHP.

But this plan allows you to see specialists and out-of-network doctors without a referral. The IRS defines a high deductible health plan HDHP as any plan with a deductible of at least 1350 for an individual or 2700 for a family. There are some differences in how the plans work for smaller bills subject to HSA deductible but they generally treat the large bill the same.

Lower out-of-pocket maximum. As the name implies an HAS is a health savings account the plan holder of which will be entitled to tax-advantages. On the other hand an EPO will typically have lower monthly premiums than a PPO.

A PPO Preferred Provider Organization refers to the network coverage your health plan. And in order to open an HSA you need to be. The main downside of a PPO is.

The difference between HSA and PPO health insurance is a distinct one where HSA reimburse for qualified medical expenses while PPO health insurance builds a network of medical service providers to choose from without the need for referrals. HSA offers tax deductions while PPOs do not. A PPO plan gives you more flexibility than an EPO by allowing you to attend out-of-network providers.

The networks are generally the same most HSA plans are PPO plans after all. The tax difference is the real focus between PPO and HSA plans. The savings from the lower premiums along with the tax-free deductions could be 5000 or more every year.

For most services youll have to meet a higher deductible before the HSA Plan pays its share of the cost of services than you would in the EPO or PPO Plans. If you know youll need more health care in the coming year and you can afford higher premiums a PPO is a good choice. HSA is a health savings account while PPO or Preferred Provider Organization is a group consisting of doctors health care providers and hospitals.

The PPO plan has a 2100 family deductible and 9900 out of pocket maximum and costs 3x as much per month. Copays and coinsurance for in-network doctors are low. May 3 2021 Reply.

Its not a choice between an HSA plan and a PPO plan. 2 Zeilen An HSA is a savings account you use for medical expenses in conjunction with your insurance. What is an HSA.

Hsa Vs Ppo Motivhealth Insurance Company

Hsa Vs Ppo Motivhealth Insurance Company

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Comparing Hdhp Vs Ppo Plans Am I Missing Something Personal Finance Money Stack Exchange

Comparing Hdhp Vs Ppo Plans Am I Missing Something Personal Finance Money Stack Exchange

Confused About Hsa Ppo Vs Regular Ppo With Similar Premium Bogleheads Org

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Why Would Anyone Choose This Ppo Over Ppo Hsa Personal Finance Money Stack Exchange

Why Would Anyone Choose This Ppo Over Ppo Hsa Personal Finance Money Stack Exchange

Think Carefully Before Signing Up For A High Deductible Health Plan

Think Carefully Before Signing Up For A High Deductible Health Plan

What S The Difference Between An Hsa And Ppo Plan Independent Health Agents

Choosing The Right Medical Plan Human Resources Purdue University

Choosing The Right Medical Plan Human Resources Purdue University

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Comparing Health Plan Types Kaiser Permanente

Choosing The Medical Plan That S Right For You

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Comparing Health Plan Types Kaiser Permanente

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.