When purchasing a breast pump through a participating DME supplier. Anthem executives argue that breast pump access will continue.

High Quality Breast Pump Is An Important Choice

High Quality Breast Pump Is An Important Choice

Anthem Blue Cross currently covers the purchase of one double electric breast pump in conjunction with each pregnancy as well as tubing breast shields valves and storage containers.

Does anthem bcbs cover breast pumps. The ACA expanded preventive benefit covers one breast pump at no cost sharing for female members any time during their pregnancy or following delivery when purchased from in-network providers. Most of the women responded to the surgery satisfactorily with a mean response on the Breast Q questionnaire of 28 2 somewhat agree. The suppliers listed below are a good place to start when choosing a breast pump.

Anthem used to pay medical equipment providers 16915 and now theyll only reimburse 95. Coverage does not include items such as totes cooler bags or extra bottles. In a blog post for new pumping.

Inevitably the mothers milk supply may decrease and cut short her breastfeeding experience. The Womens Health and Cancer Rights Act of 1998 WHCRA mandated that reconstructive breast surgery for women and men who have undergone mastectomy be covered by their benefits for those who have opted to have breast reconstruction. What is the preventive care benefit for breast pumps.

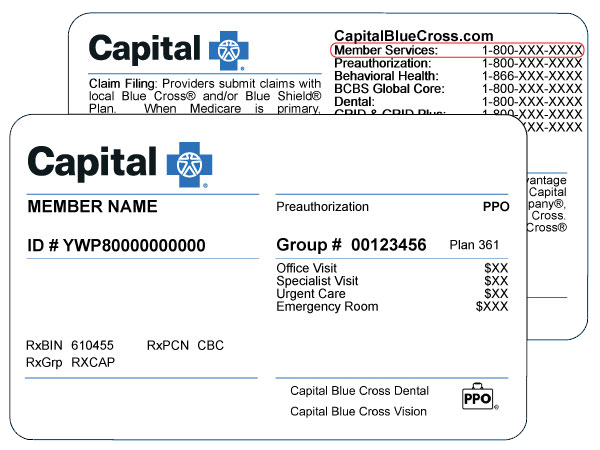

For most BCBS moms the answer is YES. 5 Breast pumps and supplies must be purchased from in-network medicalDME providers for 100 coverage. They offer high-quality choices that can help you have a successful breastfeeding experience.

But a good pump can run about 150-200 so reducing the. Before you place an order remember to check your coverage and be sure to choose a supplier thats in your plan. If you feel discomfort or see any irritation try reducing the.

Please call and verify these benefits prior to supplying electric pumps to ensure. Under the Affordable Care Act non-grandfathered insurance plans are required to cover a breast pump. In other words you can get a brand new breast pump for each baby.

It is always important to check your member benefits to confirm coverage of a breast pump. Every plan and insurer is different but thanks to the Affordable Care Act you should be eligible for a standard electric breast pump either for free or with a co-pay. The breastfeeding provisions contained within the Affordable Care Act allowed for mothers to receive a breast pump at no cost-sharing.

If youre planning on getting a breast pump through insurance youre going to want to read this. Where can Anthem Blue Cross and Blue Shield members purchase breast pumps covered under. Your Anthem Blue Cross Blue Shield insurance will fully cover the fantastic hands-free Ameda Mya Joy pump.

You can safely store breast milk at room temperature for 4-6 hours in the refrigerator for up to 5 days and in the freezer for 6-12 months. 6 This benefit also applies to those younger than age 19. 7 Counseling services for breastfeeding lactation can be provided or supported by an in-network doctor or hospital provider such as a pediatrician ob-gyn family medicine doctor or hospital with no.

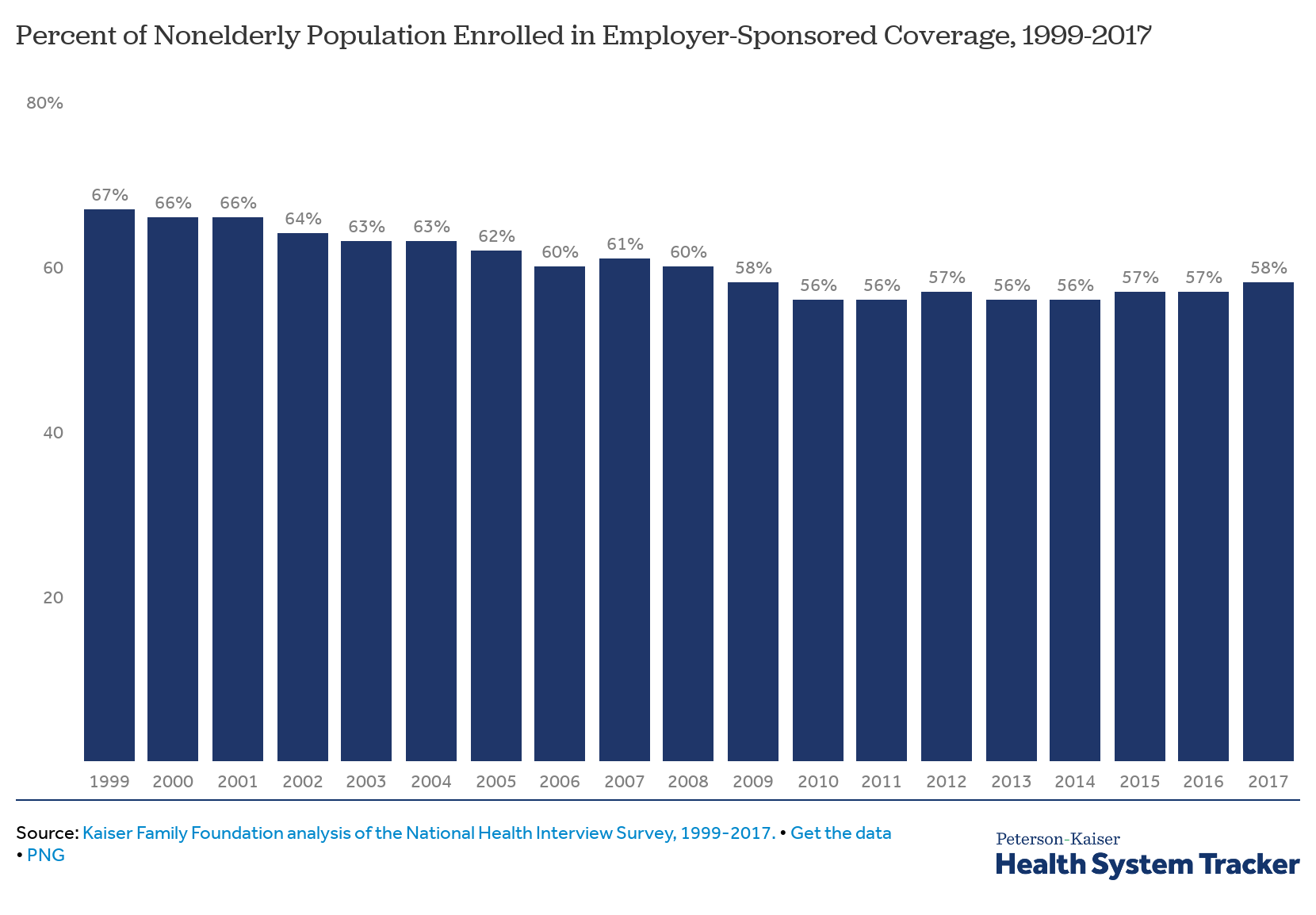

Some Blue Cross Blue Shield insurance plans not only cover a double electric breast pump but they may also cover replacement parts for your breast pump as well. Anthem BCBS Cuts Coverage for Breast Pumps by 45 On April 1st 2018 Anthem Blue Cross Blue Shield cut breastfeeding support for the purchase of breast pumps for its customers by 45 from 16915 to 95. That standard however may have to lower for some new moms since Anthem Blue Cross Blue Shield plans to cut its reimbursement amount for.

Electric breast pumps will be covered up to the maximum allowable charge of manual breast pumps. Relaxation is essential to release oxytocin which stimulates your let-down reflex so have everything you need close by while pumping. Review your benefits for more information.

The Breast Q questionnaire was completed once after surgery and retrospective chart reviews were also completed to assess individual outcomes and determine whether any correlation exists between outcomes and size or amount of breast tissue removed. Does my Anthem breast pump benefit cover deluxe pumps like wearable breast pumps or hands-free breast pumps. But all breast pumps are not equal.

The price of different flange sizes storage bags replacement tubing and more can add up quickly if theyre not covered. Many benefit plans offer pregnant women access to personal use standard double electric breast pumps through many of our contracted equipment suppliers at no cost to them. Breast pumps are often covered under the Womens Preventative benefit and are sometimes covered under the durable medical equipment DME benefit.

All these factors influence how well they remove milk from the breast or can cause pain. Electric breast pumps may be covered by certain employer groups. Most of our individual and employer-based plans cover the cost of high-quality breast pumps.

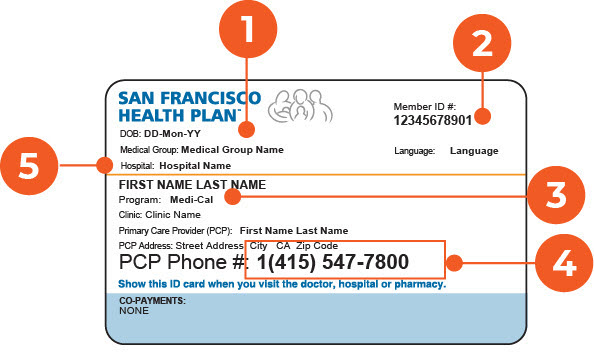

For example BCBS Florida and BSBC New Jersey both require that you have a prescription and prior authorization to access your free coverage. Service Benefit Plan members who are pregnant andor nursing are eligible to receive one breast pump kit per calendar year when ordered through CVS Caremark by calling 1-800-262-7890. Most BCBS plans will cover the full cost of a double electric breast pump but some states or policies have limitations and contingencies in place.

They differ in technology motor type and in pump strength and durability. Sanitize pump parts at least once per day. In individuals who have undergone a medically necessary lumpectomy surgery to create a more normal anatomy is considered.

This doesnt go hand-in-hand with the retail price you would pay for a pump off the shelf or the final price that a new mom covered under Anthem will pay once this goes into effect.