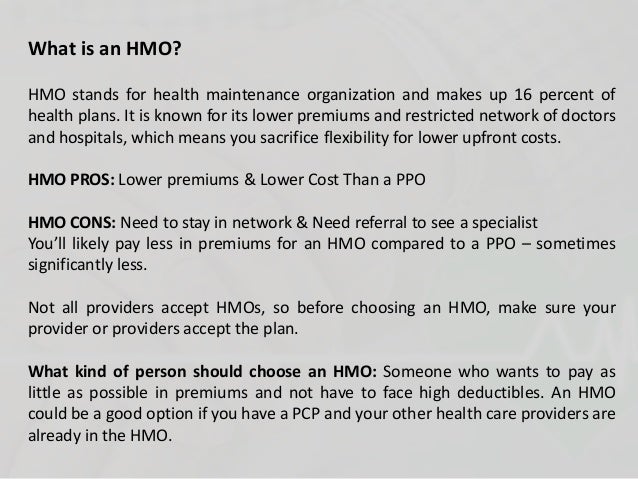

This reduces costs so your monthly payments will be lower. PPOs preferred provider organizations are usually more expensive.

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

According to an analysis of plans sold in the 36 states for which the federal government runs the online insurance marketplace as well as the plans sold on the California exchange HMO offerings.

What is epo and ppo. A health plans network is the set of healthcare providers eg hospitals doctors and specialists with whom the insurance company has contractual agreements in any given plan year. Most plans fall into three types -- EPO HMO and PPO. An EPO stands for an exclusive provider organization says Levitt.

In exchange you will likely get a larger network and the ability to see a provider outside that network. Exclusive provider organizations EPOs are a lot like HMOs. And an EPO is much like a PPO in that you have a fair amount of flexibility in how you use your services.

Just like an HMO coverage is limited to only doctors within a network. The more a plan pays for out-of-network. An EPO or Exclusive Provider Organization functions as an HMO but does not require all care to be funneled through a primary care physician and no referrals are needed to see a specialist.

The PPO EO and the DEO are all intended to function as court orders against family violence. In-network versus out-of-network care. PPO health plans have access to those negotiated rates.

You can also see specialists without a referral. Similar to an EPO a PPO network is made up of those doctors and facilities that have negotiated lower rates on the services they perform. PPO or Preferred Provider Organization health plans are generally more flexible than EPO Exclusive Provider Organization plans and have higher premiums.

4 rijen Exclusive Provider Organization EPO EPOs got that name because they have a network of providers. Members however may not. The Personal Protection Order PPO is a court order available under Part VII of the Womens Charter.

Like a PPO an EPO plan member does not require authorization from a PCP to see a specialist. There is also a third option Exclusive Provider Organization EPO which is growing in popularity in California. The differences between the three is largely based on the need to stay in a network of physicians and the need for a primary physician among.

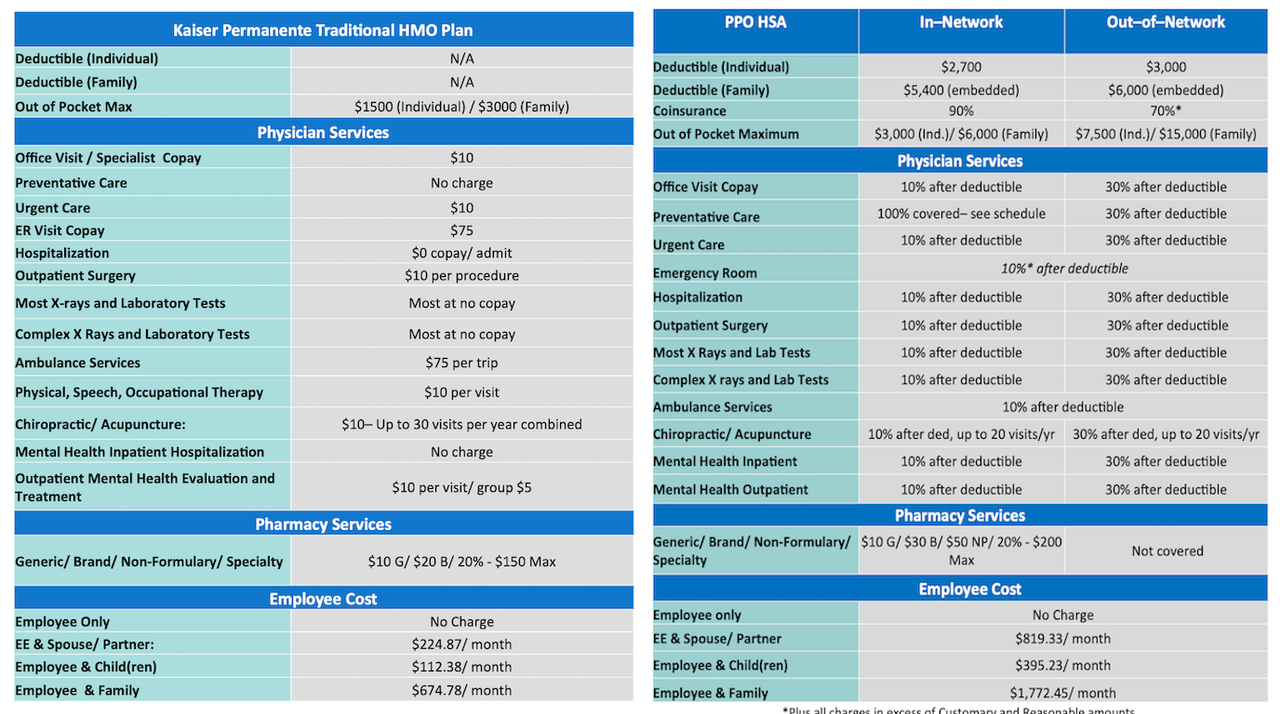

EPO stands for exclusive provider organization and doesnt cover any out-of-network care. A Health Maintenance Organization HMO plan is one of the cheapest types of health. In California health insurance plan options primarily include Health Maintenance Organization HMO and Preferred Provider Organization PPO.

It is supplemented by the Expedited Order EO and the Domestic Exclusion Order DEO. EPOS exclusive provider organizations combine features of HMOs and PPOs. According to an analysis of plans sold in the 36 states for which the federal government runs the online insurance marketplace as well as the plans sold on the California exchange HMO offerings made up 40 percent and PPOs another 40 percent.

They generally dont cover care outside the plans provider network. HMO POS PPO EPO and HDHP with HSA. As with an HMO a Point of Service.

Exclusive Provider Organization EPO An EPO plan is like a hybrid of a PPO plan and an HMO plan. However like an HMO an EPO plan member does not have out of network benefits except for emergency services. A Blue Dental EPO plan only covers services from in-network PPO dentists.

However EPOs also tend to have higher premiums than HMOs. With an EPO exclusive provider organization insurance plan enrollees get more flexibility in the providers they see because they dont have to get pre-approval from their PCP primary care physician. An affordable plan with out-of-network coverage.

To successfully apply for a PPO 2 elements must be proved. This comparison explains how.

.jpg)