Your Plan F coverage or Plan G coverage will pay it for you. For starters it wont cover the cost of your annual Part B deductible.

High Deductible Plan G What Are The Facts Gomedigap

High Deductible Plan G What Are The Facts Gomedigap

You also wont have to worry about.

What does plan g cover. The following are the healthcare costs that Medigap Plan G covers. What Plan G Doesnt Cover. This excess charge is then your responsibility to pay.

Our insurance plans arent able to cover injuries illness deaths or hospital visits that happen because your pet is pregnant or has given birth. These are all medical costs that are not already covered by Medicare and its basic plan. Heres a quick look at what costs Plan G covers.

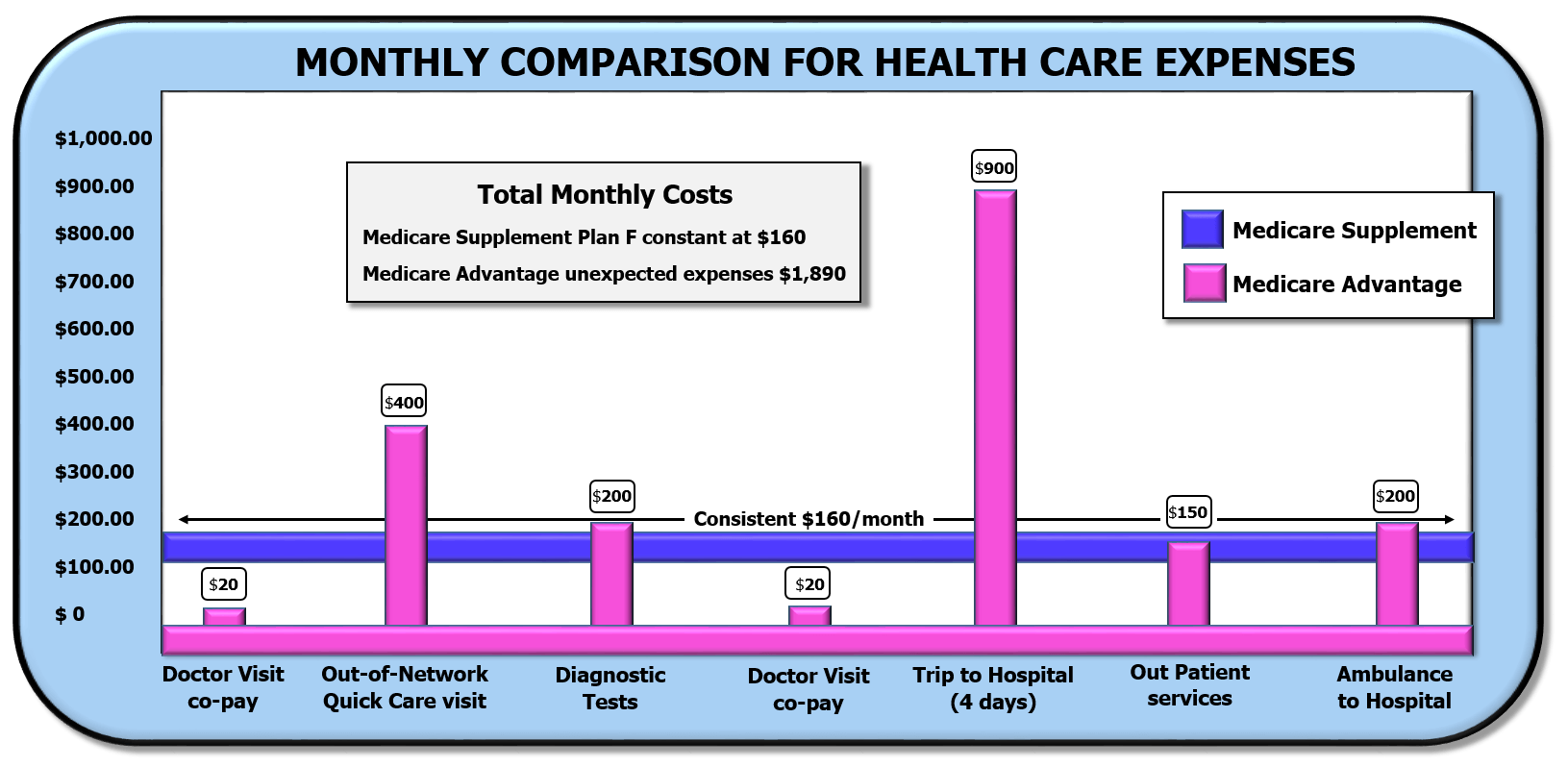

The Part B deductible in 2020 is 198. Plan G covers Skilled Nursing and rehab facility stays and also Hospice care. Medicare Supplement Plan G covers your share of any medical benefit that Original Medicare covers except for the outpatient deductible.

Although MedSup Plan G helps you pay most of the healthcare costs Original Medicare or Medicare Part A and Part B doesnt cover it doesnt help you pay all of them. Pre-existing illness or injury. These expenses may not all apply to you but you need to know about them anyway and what Plan G will do.

Here is the list of items that Medicare Supplement Plan G in 2021 will cover for each and every senior. Plan G and many other Supplement plans provide coverage for that coinsurance. This is nice because you dont have to worry about whether your doctor is one who charges excess charges.

This means you should plan to pay for it out of pocket. It also covers outpatient medical services such as doctor. Medicare Supplement insurance Plan G includes the following basic benefits.

Now Plan Ga new option for new Medicare enrollees beginning January 1 2020offers the closest available coverage to what was Plan F. For example MedSup Plan G doesnt cover the Medicare Part B deductible. Some doctors decide to charge 15 more than Medicare pays them.

94 lignes PharmaCare covers Methadose buprenorphinenaloxone and Kadian 24-hour. Plan G Coverage What Medical Services Does Plan G Cover. Skilled nursing care coinsurance Medicare Part A copayment.

This means youll either have to enroll in a stand-alone dental plan. So it helps to pay for inpatient hospital costs such as blood transfusions skilled nursing and hospice care. The only difference is that Plan G makes the beneficiary pay the Medicare Part B deductible out-of-pocket.

So what does Plan G cover. Plan G covers 100 of the Medicare Part A and Part B co-pays and coinsurance those gaps and holes that Medicare doesnt cover. Plan Gs coverage is nearly comprehensive.

Medicare Supplement Plan G covers most of the out-of-pocket. Plan G is a type of supplemental insurance for Medicare. Supplemental insurance plans help cover certain health care costs such as deductibles coinsurance and copayments.

In fact Plan G and Plan G are the only two plans that cover excess charges. Plan G doesnt cover routine dental care. Medicare Part A hospital coinsurance and all costs up to 365 days after Original Medicare benefits are exhausted Part A hospice care coinsurance or co-payment.

Medicare Part A coinsurance and hospital costs up to 365 days after your Medicare benefits are used up Medicare Part B coinsurance or copayments first 3 pints of blood for transfusions Medicare Part A hospice care coinsurance or. Without a supplement plan youd have to pay those expenses yourself. Unfortunately Plan G doesnt cover every type of medical expense.

But we do work with breeders to provide pet insurance with immediate cover for puppies and kittens that breeders are free to issue to owners please visit Petplan Breeder for more information. Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits are exhausted Part A hospice care coinsurance or copayment. Getting Plan Gs coverage means that you are covered for most supplemental medical expenses.

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used Medicare Part B coinsurance or copayment Blood first 3 pints Part A hospice care coinsurance or copayment Skilled nursing facility care coinsurance Part A.