For almost 20 years Medicare beneficiaries have been able to enroll in HMOs. These demonstrations are designed to test innovative marketing techniques benefit packages and reimbursement levels.

Best Medicare Advantage Plans For 2021 Medicarefaq

Best Medicare Advantage Plans For 2021 Medicarefaq

Medicare Risk HMOs are health insurance plans that administer the.

Hmo medicare risk plan. In some plans you may be able to go out-of-network for certain services. Unfortunately relatively few HMOs offer Medicare risk plans in rural areas. Between 1995 and 1999 enrollment in these plans here collectively called Medicare HMOs doubled reaching more than 6 million in 1999.

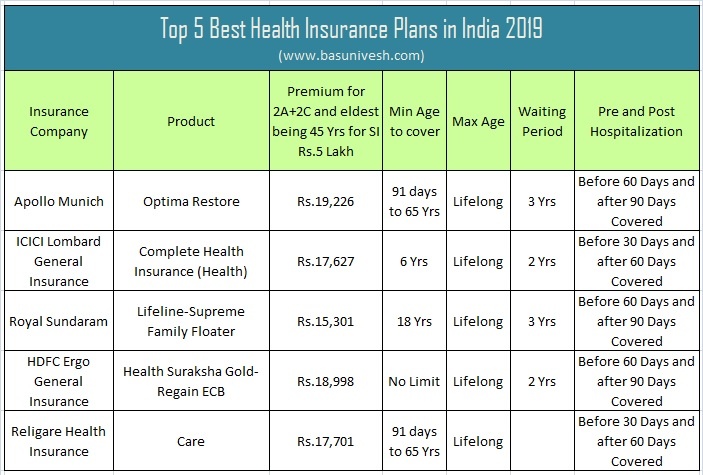

Humana also has a combination of HMO-owned medical centers and. If you have Original Medicare you also have the choice to purchase a supplemental insurance policy or Medigap. Aetna HMO Plan Member Handbook NJgov.

Finden Sie es direkt auf Comparis heraus. Three of the HMOs in the risk sample. Finden Sie es heraus.

Finden Sie es heraus. IN THIS ISSUE 1. Medigap plans cover Medicare cost-sharing and offer other benefits charging an.

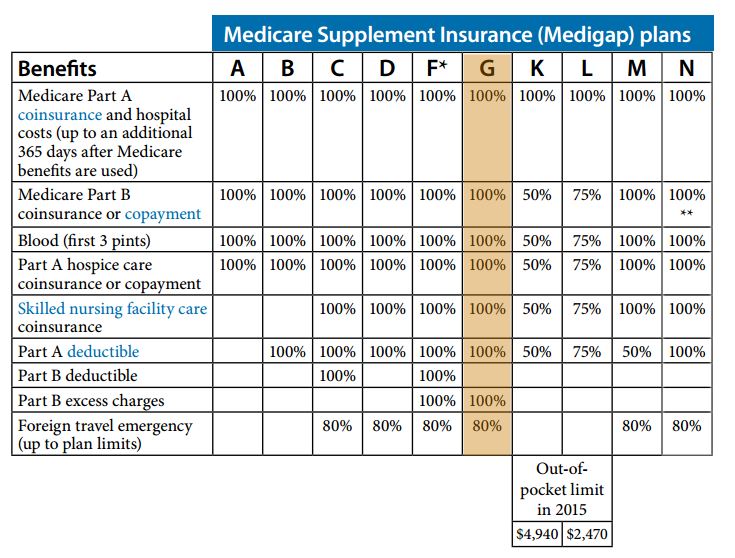

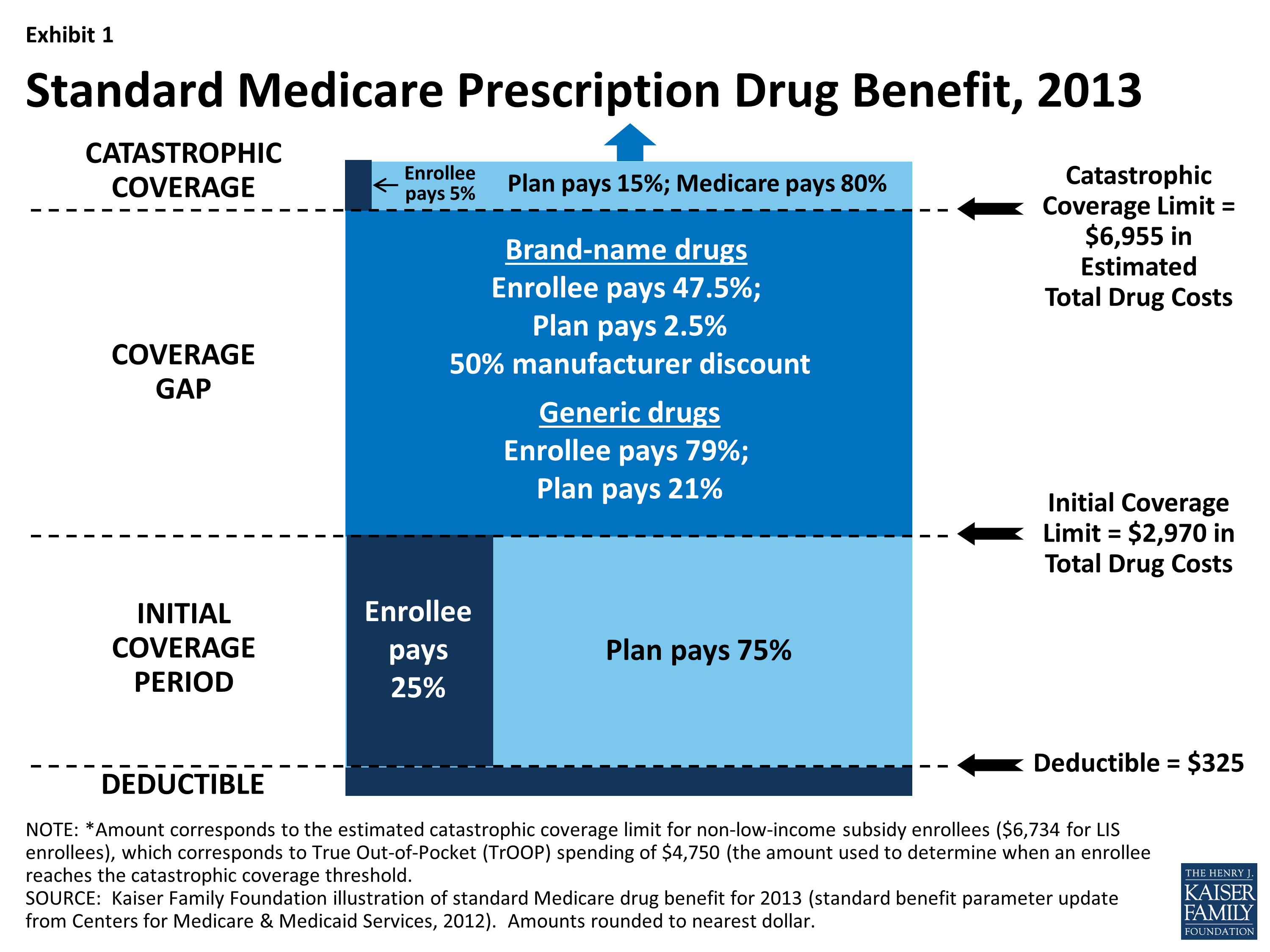

Risk of heart attack and stroke. HMOs offer a Medicare risk plan. Over the same period a rising majority of plans offered coverage for prescription drugs often with zero premium Gold 2001.

In order to serve them HMOs have had to enter into con-tracts with the Health Care Financing Administration HCFA. The call is free. Risk HMO A health plan in the US which assumes insurance risk and receives a capitated payment for each enrollee amounting to 95 of the average local payment for traditional Medicare.

Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. MedicareChoice risk HMO plan. A Medicare Advantage Health Maintenance Organization HMO plan is a Medicare approved health plan that provides you with access to a network of doctors and hospitals that coordinate your care with an emphasis on prevention.

As a consequence it will have to meetDHHSs requirements of such plans. This is called an HMO with a point-of-service POS option. The interviews were conducted from May through early September 1997.

Humana runs a Medicare Advantage plan. Finden Sie es direkt auf Comparis heraus. Anzeige Welche Leistungen sind im HMO-Modell inbegriffen.

Medicare health maintenance organization HMO plans are a type of Medicare Advantage plan. State of New Jersey. At each HMO one or more senior managers who were knowledgeable about the HMOs Medicare risk product or the HMOs decision not to offer the prod-uct were interviewed.

Medicare risk HMO plans served approximately 24 milLion beneficiaries an increase of. Medicare risk HMOS in light of our recent beneficiary survey data. Assumes the risk associated with insuring.

Was beinhaltet das HMO-Modell. 11-2664 Third Circuit. The Health Care Financing Administration HCFA has initiated several demonstration projects to encourage HMOs to participate in the Medicare program under a risk mechanism.

And a yearly repeat screening for certain people at high risk. The HSA Expert Health Revival Athens GA Medicare risk is a term used to describe an HMO-like style of delivering Medicare benefits in which a patient pays a set dollar amount to a Medicare risk provider who then takes on responsibility for delivering all health care. The most common types of prepaid health plans are risk-contracted HMOs.

Insurance Medicare Advantage health plans Medicare Part D. Message service available on weekends and holidays from April 1September 30. Was beinhaltet das HMO-Modell.

CFHP Medicare Advantage Plan HMO is an HMO health plan with a Medicare contract. In HMO Plans you generally must get your care and services from providers in the plans network except. MEDICARE RISK HMO INDICATOR 2.

In addition several HMOs have selectively dropped rural counties from the service areas of their Medicare risk contracts. Between April 2018-April 2019 Medicare will be sending new Medicare. In this article we.

Pros Risk HMOs save money for Medicare provide expanded benefits guarantee enrollment and allow easy disenrollment. The plans are offered by private insurance companies with varied coverage and costs. Plans regarding Medicare risk products in rural areas.

Thus the promise of HMOs improving access to care for Medicare beneficiaries is. But it usually costs less if you get your care from a network provider. Make sure your HMO plan provides Part D coverage if you need it.

If you have questions please call CFHP Medicare Advantage Plan HMO at 1-833-434-2347 8 am to 8 pm 7 days a week. The last half of 1990s under the Medicare risk and MedicareChoice programs. Medicare Plan HMO will be the primary insurance plan.