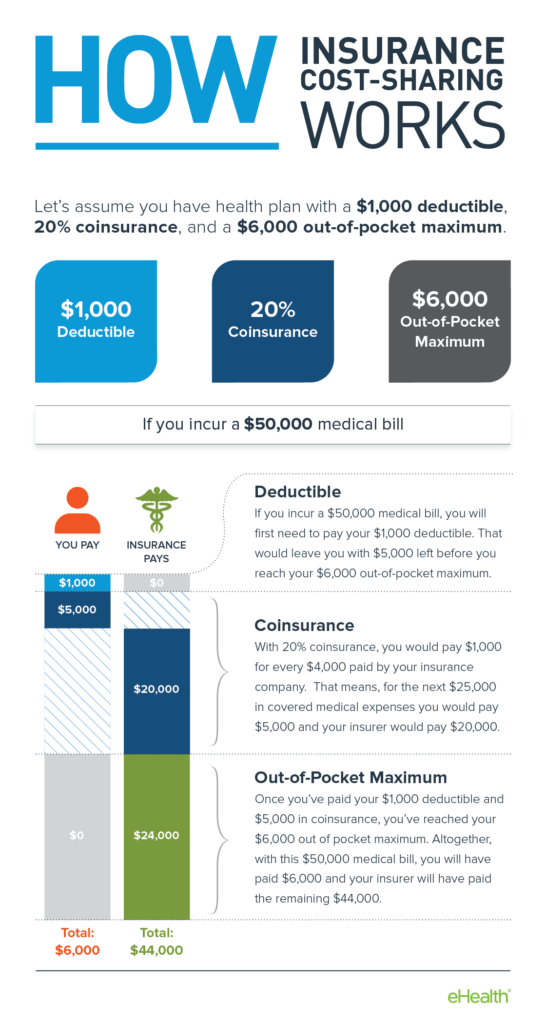

Find out what your deductible would be in the event of coverage. Cosmetic and Reconstructive Surgery.

Pdf Plastic Surgery Secrets Plus Read Online

Pdf Plastic Surgery Secrets Plus Read Online

Treat your lipedema by having your surgeries fairly covered by your insurance without having to pay tens of thousands of dollars out of pocket.

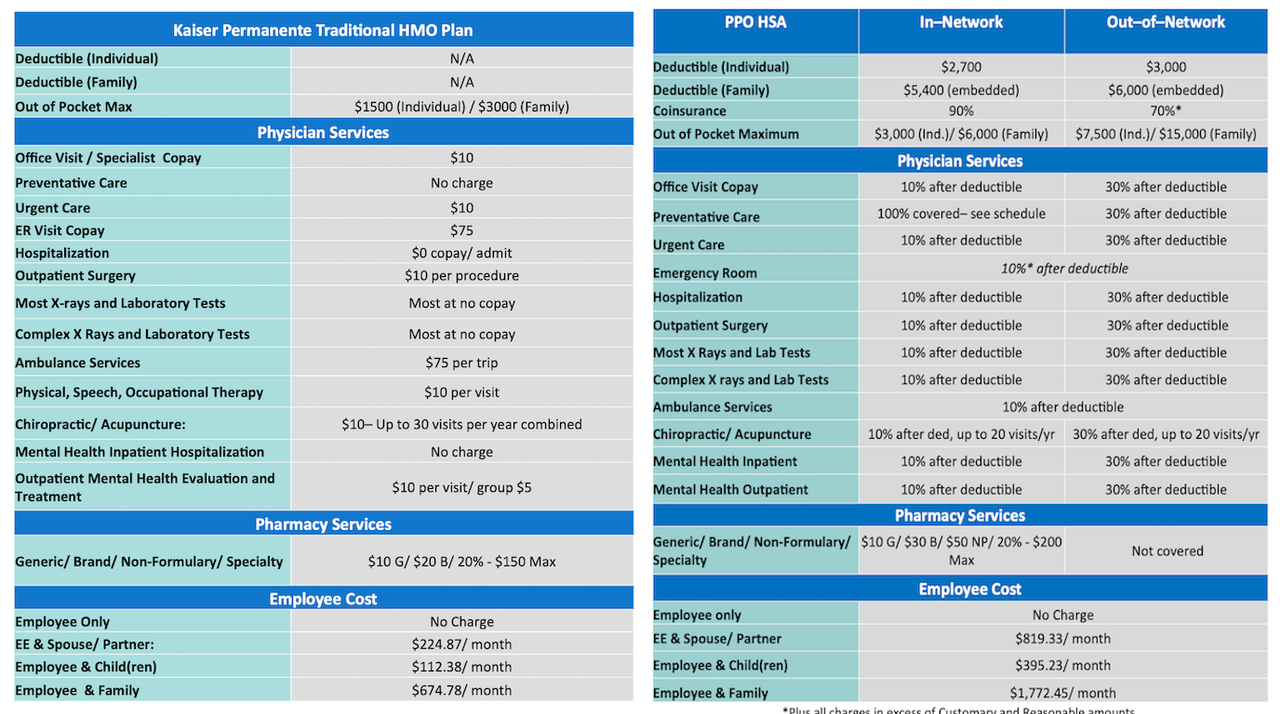

Does blue cross cover plastic surgery. Are video visits with a Plastic Surgeon online covered by Blue Cross Blue Shield. You can discover a checklist of not successful does blue cross blue shield cover cosmetic surgery on the website. How much is skin removal surgery exactly.

According to Blue CrossBlue Shield of California Medically Necessary Panniculectomy is considered medically necessary for the individual who meets the following criteria. Otoplasty for large or protruding ears. This policy excludes the coverage of abdominoplasty and lipectomy surgical procedures due to the procedures being cosmetic in nature.

It may cover the cost of a hernia repair. Often customers go too far in the need to be excellent or the doctor can not manage the job and we see not successful outcomes of plastics. An Independent Licensee of the Blue Cross and Blue Shield Association.

Reconstruction of disfiguring or extensive scars resulting from neoplastic surgery providing there has been continuous coverage under the group since the surgery may be covered. Abdominoplasty including mini abdominoplasty or modified abdominoplasty for all indications with or without repair of abdominal wall laxity or diastasis recti is considered cosmetic and non- covered. These are the general baseline costs for the most common plastic surgeries to loose skin after weight loss according to the American Society of Plastic Surgeons.

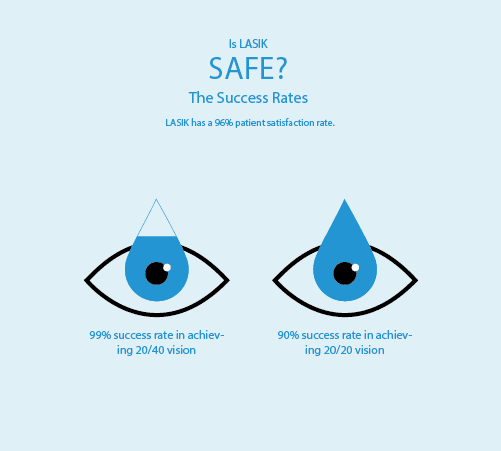

Contact your health insurance plan administrator or insurance company directly and find out what coverage you have for plastic surgery procedures. Does Blue Cross Blue Shield Federal cover tummy tucks. LASIK is considered an elective procedure and health insurance coverage of LASIK varies depending on whether dedicated monthly premium dollars go to cover the LASIK eye procedure.

How can I get my insurance to pay for a tummy tuck. Will Blue Cross Blue Shield of NC pay for an abdominoplasty if its needed to reconstruct scars. Most insurers provide coverage for video visits at the same cost as in-person visits.

Get an accurate estimate with detailed costs prediction for your plastic surgery procedure so you can review this against your policy coverage. Aetna Anthem Blue Cross Blue Shield Cigna and United Healthcare all cover the majority of or parts of gastric sleeve surgeries for patients that meet the eligibility criteria. Plastic surgeons that accept Blue CrossBlue Shield.

Is Lasik covered by Blue Cross Blue Shield. As a general rule the surgery should be performed within two years of the accident or initial injury. Nonetheless not all does blue cross blue shield cover cosmetic surgery work marvels and end effectively.

Blue Cross Blue Shield does cover a revision surgery if it is needed. It is generally performed to correct signs of aging facial rejuvenation. When Brow Lift is covered.

Most large health insurance plans such as Blue Cross Blue Shield Massachusetts do not cover LASIK surgery. You can search on Zocdoc specifically for Plastic Surgeons who accept Blue Cross Blue Shield for video visits by selecting your carrier and plan from the drop-down menu at the top of the page. How much does it cost to remove excess skin after weight loss.

CoverLipedema walked me through the process of getting my insurance company to cover the costs of multiple pain-reducing mobility-increasing procedures. Have a routine physical and talk to your doctor about. Claims for services beyond two years will be reviewed for determination of functional impairment.

Plastic surgical procedures of the face including cosmetic procedures of the eyelids lower face and neck. Reasons for failure of the surgery Date and type of procedure. However this would not be expected to cover breast augmentation or abdominoplasty.

Many surgeons accept Blue Cross. Gateway Health provides coverage under the medical-surgical benefits of the Companys Medicaid products for medically necessary panniculectomy surgical procedures. Reconstructive Eyelid Surgery and Brow Lift.

An Independent Licensee of the Blue Cross and Blue Shield Association. Visit your primary care physician. My guess is that plastic surgery may be covered if you can prove issues with rashes sores and so forth.

They do require that certain documentation is provided by the physician including.